There are so many amazing things in the world of cryptocurrency that it never repeats itself for the people involved. Decentralized applications and DeFi domains are among the attractions that deliver new concepts to their users every day. (Yield Farming) is one of the concepts in this field a way to make money for investors. Yield farming means lending or investing your assets to earn rewards and generate profits in the field of digital currency.

Yield farming encourages people active in the digital currency market to deposit their assets into liquidity pools and reward them in return. The most popular and well-known DeFi protocol runs on the Ethereum network, which is why most Yield farming platforms are powered by the ERC-20 symbol. In the next section, we will answer questions such as Yield farming and its general concept.

Definition of Yield farming

Yield farming, also known as liquidity mining or liquidity mining, is a way to generate rewards from owning the digital currency. In simple terms, this means locking cryptocurrencies into a protocol and then receiving rewards. To some extent, yield farming is similar to staking cryptocurrency. But behind the scenes, the two have their differences. In most cases, yield farming means working with people called Liquidity Providers, or LPs, who provide liquidity by adding funds to liquidity pools. The liquidity pool is a smart contract with a certain amount. LPs are rewarded for providing liquidity to the pool. This reward may come from commissions generated by the respective DeFi platform or commissions generated in other ways.

Yield farming is generally done from Ethereum ERC20 tokens; rewards will be paid in ERC-20 tokens. Because currently most of the activities of this sector take place within the Ethereum ecosystem. Yield farmers generally look for more income than profit and for this, they shift their funds between different protocols. As a result, DeFi platforms offer other economic incentives to attract capital to the space. As with centralized exchanges, more liquidity attracts more liquidity.

The reason for the explosion in the popularity of Yield farming

At the root of encouraging traders to yield farming is the creation of the Governance Token by the Compound Ecosystem. Thanks to feedback or management indicators, it is possible to provide feedback to its owners on how the ecosystem is functioning. The question presented here is, if you want to enable networks, how can these signals be distributed? A common way to create a decentralized blockchain is to distribute voting tokens according to a certain algorithm without incentivizing liquidity. This feature will attract liquidity providers to purchase new tokens by injecting liquidity into the related protocol.

Of course, the COMP token is not the creator of efficient agriculture, however, its launch has made this type of token distribution model popular. Since then, several other DeFi projects have emerged, offering innovative designs aimed at attracting liquidity to their ecosystems.

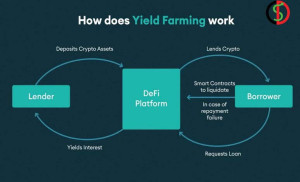

How does yield farming work?

When it comes to how yield farming works, you should consider that liquidity providers, or users, deposit their digital assets into liquidity pools these pools are a marketplace where users can lend or borrow and trade their tokens. On the other hand, to use this platform, users must pay a fee that will be shared among the liquidity providers, and this is exactly the basis of how this concept works. The portion that users receive or pay depends greatly on that platform and the smart contracts that are executed on it. Users who deposit and pay their money in the pool will receive special benefits and tokens.

On the other hand, some users put their capital in the pool and get a loan in the lock. The borrower must return the amount of the loan with interest to the pool according to the term of the contract, and if he does not do so within the desired term, his assets already blocked in the pool will be removed from his reach. All this happens automatically through smart contracts. Note that users who use dividend farming usually move their funds between different protocols to get more rewards therefore, DeFi platforms can use other economic incentives to attract more capital to their network platform.

The best yield farming strategy for profit

In yield farming, users can use arteries like currency markets, liquidity pools, and incentive schemes to carry out this process and earn profits. In general, in the concept of yield farming, there are 3 ways to make a profit, which we will discuss in each case below:

1. Money markets

Typically, cryptocurrency holders monetize their digital assets by lending their tokens to platforms like Compound, Maker, and more. In principle, to lend a specific asset, the lender must be provided with a promise to guarantee the payment of the loan amount received, and in Yield Farming this issue will also depend on the protocol chosen by the user. But the most important thing is that you should always pay attention to the security level of this protocol. If the value of the user’s share falls below the minimum amount established in the protocol after market fluctuations, his security will be liquid and as a result, the user must increase the amount of his share to correct this fluctuation.

In general, each platform has a different collateral rate, and besides that, most platforms also struggle with excessive collateralization or collateral saturation (Overcollateralization). Finally, The peculiarity of the DeFi money market is that the borrower’s collateral must be greater than the amount of the loan they have withdrawn and This means that if farmers do not repay the loan on time, they have to deposit more than the required amount to avoid losing their property.

2. cash pools

Liquidity pools are smart contracts that allow users to receive specific rewards by providing liquidity to these pools This reward is provided by transaction fees on a DeFi platform or fees collected from borrowers on a lending platform.

3. Motivation plans

Those engaged in yield farming will have the opportunity to recoup their investment in the form of incentive plans from various platforms. For example, the Synthetix platform offers users SNX tokens in exchange for liquidity, or the Ampleforth platform, allows users to earn AMPL tokens in exchange for liquidity.