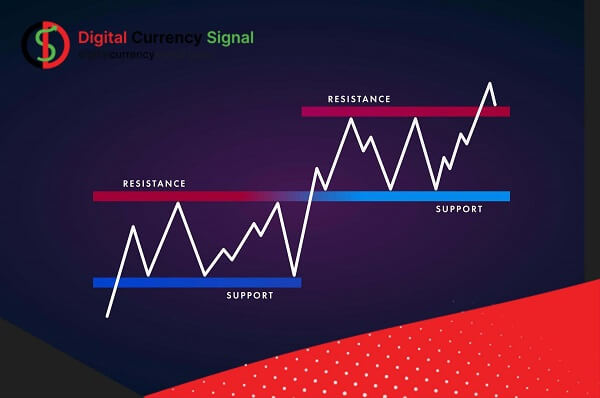

One of the most important aspects of cryptocurrency analysis is undoubtedly the concept of support and resistance levels. Identifying support and resistance levels can be subjective. Also, these levels have different functions depending on the changing market conditions, so you need to understand the different types. Technical analysts use support and resistance levels to identify points where there is a possibility of price movement lagging or a price trend reversal. Once support and resistance areas are identified, they can be used as potential entry or exit points. But what is support and resistance on the chart? Below we define support and resistance separately:

Support levels

Support is the level of the price chart that is expected to stop the downward trend due to increased demand or willingness to buy. These levels are particularly attractive to buyers. When the price reaches this level, demand in the market increases and this causes the price to rise. In fact, when the price of a currency or other asset falls, the demand to buy it increases, that is, the amount of demand exceeds the amount of supply, which leads to an increase in price and creates a line of support on technical charts.

resistance level

Resistance is the price level at which an uptrend is expected to stop due to increased supply or willingness to sell. A resistance level is created when the market’s willingness to sell increases. At this price level, sellers and traders sell a lot when the price reaches this level. Because at this stage the price drop is not as far as expected. At the resistance level, selling pressure dominates the market and causes the price to decline and continue the downtrend.

When the price reaches a support or resistance level, one of two things happens to the price:

The price recovers from these areas or breaks this price level and continues its movement in the previous direction until it reaches another support or resistance level. In fact, several traders limit their time by assuming that they have failed. If the price movement is stopped by support and resistance levels and if the price can break these levels, traders can predict the future price direction and trade based on that. If the exchange rate moves in the opposite direction to the expected direction, you can exit the trading position with a small loss. But if the forecasts turn out to be correct, a significant move is coming.

Reasons for the formation of support and resistance points

As mentioned above, support and resistance in crypto technical analysis are created based on the law of supply and demand. In fact, the desire of the market to buy more increases the price and vice versa, the desire of the market to buy cryptocurrencies lowers their price. These concepts act as barriers in the way the price of cryptocurrencies rises or falls, to control excessive price fluctuations and keep them within a limited range. On the other hand, analyzing these concepts is used to obtain buy and sell signals to minimize losses and maximize profits from market fluctuations.

How do you use support levels to trade?

- Entering a buy position (Long): You can enter the market just above the support level. One of the best ways to do this is to open a position when prices just touch a support zone and bounce back. Although this case is not 100%, it increases the probability of an upward movement. ‘

- Place a stop loss: When you open a position, you can set the loss below the support level to determine your loss if the price goes in the wrong direction.

How do you use resistance levels to trade?

- enter a sell (short) position: Just the opposite of a support system, you can enter the market just below the resistance level. A good way to do this is to open a position when the price hits a resistance zone and reverses. Prices are expected to decline in these ranges.

- Adjust the stop loss: You can set a Stop Loss slightly above the resistance level.

- Exit from long positions: Traders who have opened a long position can close their position if the price reaches the resistance level several times and cannot break it.

- Save or store profits: For day traders, resistance zones can represent profit storage. You can close your positions around the area and keep the profit.

Benefits of trading with support and resistance

1.Help create a better strategy

The cryptocurrency market is known for its high volatility. Without a proper strategy new traders face a lot of losses in this market. Resistance and support lines allow traders to plan their trades and react to market fluctuations to make more profitable and more rational decisions.

2. detect market trends

The ability to recognize market trends is very important for traders. Support and resistance levels provide a good overview of market direction. For traders in the futures market, entering the right time and place can increase profit potential.

3. Search for entry and exit points

Traders use these levels to identify market entry and exit points (as explained earlier).

4. risk management

These areas are also used as risk management tools. For example, a trader with a long position can place his stop loss below the support level and avoid further losses. Also, short position traders place their loss limits above the resistance line to minimize their losses.

Conclusion

Support and resistance levels are one of the key concepts used by technical analysts and form the basis of a wide range of technical analysis tools. Fundamentals of support and resistance include a support level that can be considered a price floor and a resistance level that can be considered a ceiling. Prices fall (rise), test support levels (resistance), either hold and price is higher (lower), or the support level (resistance) is broken and the price continues to move, possibly to the next support level (resistance) moved lower (higher).