To know what an OCO order is and when to use it, it is worth paying attention to the fact that each order used in various transactions in the financial markets is like a tool that can be used in specific situations . Situation. Are. In the financial markets, there are different types of orders to buy and sell assets and stocks. Depending on the trader’s goal, these orders can be executed in different ways. For example, market, limit, and stop orders are three important types of orders in the financial markets. Additional order types can be obtained by combining these three order types. OCO order is also a type of mixed order which aims to reduce trading risk.

Understand the concept of OCO queue

Sometimes in life you can only have one thing, but you can’t have two things at the same time. The weather can be sunny or cloudy with rain; It can’t be both. Let’s say you have $20. You decide to spend it with an umbrella if it’s raining or sunglasses if it’s sunny. You are prepared for both possible scenarios, but only one will succeed. If it’s sunny outside, you buy sunglasses instead of an umbrella, and vice versa.

If we apply this analogy to the financial markets, you will better understand the idea of an OCO order. With this trade order, the investor creates a plan if the value of the traded asset increases or decreases. This is simply an OCO request. The concept is to instruct the trader to automatically stop the order if another order reaches the target first. There are usually two types of requests in this situation.

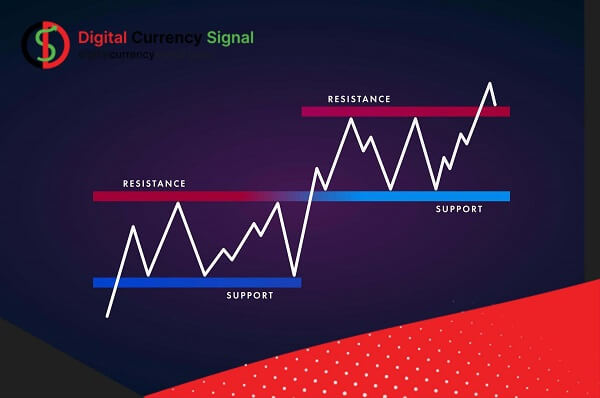

An OCO order is a pair of conditional orders; If an order is successful, the corresponding order will be canceled automatically. Dual orders (usually a stop order and a limit order) are offered on most cloud-based trading platforms. When a trade reaches the stop or limit price and the order is executed, the partner’s order will be canceled automatically. Traders can use OCO orders to trade corrections and breakouts. If a trader wants to trade a break above resistance or below support, they can place an OCO order that uses a buy and sell stop to enter the market.

For example, if the stock is trading between $20 and $22, an investor can place an OCO order with a buy stop just above $22 and a sell stop below $20. If the price breaks below the resistance level or below the support level, the trade will be executed and the corresponding stop order will be canceled. Conversely, if a trader wants to use a corrective strategy that buys at support and sells at resistance, he or she can place an OCO order with a buy order with a $20 limit price and a sell order with a $22 limit price.

The OCO order is also used as a risk management tool, something that is often overlooked. Planning ahead and knowing which risk management tools to implement is at the heart of your portfolio management. There are endless possibilities for investors when using OCO orders as a risk management tool.

What is OCO chain in digital currency market?

The OCO order is a special type of order registration on the exchange, which allows the trader to register two independent orders at the same time. OCO stands for “one cancels the other”. This type of order registration allows the trader to place two different types of orders simultaneously depending on the trade positions he sees on the price chart. Of course, only one of these commands can be executed, and executing one of these commands automatically overrides the other command. An OCO order is a combination of a limit order and a stop limit order.

We all know that crypto trading has become the hottest trading market today compared to gold, oil or stock market. There is no doubt that this is an attractive market for traders worldwide but unfortunately success is not as easy as it seems. The price of Bitcoin and other digital currencies goes up and down every hour. To be successful in crypto trading, you need an effective strategy and plan. Apart from having the right strategy, you also need the best digital currency exchange platform to ensure that you can easily buy and sell crypto assets.

There are thousands of virtual currencies, proprietary tools and sound trading strategies that promise to make you rich. We all know that volatility is a big part of the cryptocurrency market. The great volatility and instability of the market can quickly activate cryptocurrency exchanges that many begin to ask how experts can translate these scary activities into available. Therefore, it can be said that setting limit orders or other types of maximum orders is a solution for traders to make profits in cryptocurrency trading. These instructions allow you to earn income at the right time and you are not allowed to lose your money. While placing orders, you only need to select the price at which you want to buy or sell the currency and when your target price reaches that level. , your order will be fulfilled.

Let’s say a trader has 1000 bitcoins that trade for $100 Investors expect Bitcoin to trade in a wide range and target $130 in the short term. To minimize risk, they don’t want to lose more than $20 per coin Here, the trader can place an OCO order, which can include a stop loss order to sell 1000 BTC at $80 and a simultaneous limit order to sell 1000 BTC at $130. Whatever happens to the first, the second is automatically cancelled

What is the effectiveness of the OCO command?

Depending on the trading method you use and the financial market you are active in, the number of hours you need to monitor the markets may vary. For example, traders might consider different trading hours depending on when the London or New York markets open. On the other hand, the digital currency market is non-stop and can be used at any time.

Therefore, it is more useful in the cryptocurrency market orders that allow traders to better control price movements. This type of order, such as OCO, allows the trader to rest hours outside the market or monitor other markets in parallel and execute trades there as well.

One of the advantages of this type of product for sellers is that, according to the order registration system, the operation is carried out automatically according to the defined conditions. For example, a marketer conducts a market analysis and after identifying the entry and exit points, makes a plan. The OCO method is one of the methods of regular registration on the financial markets, thanks to which the trader can accurately control the positions at different times. Here are some of the benefits of using OCO products in business.

Why should a trader use an OCO order?

Many traders use OCO orders to minimize risk when entering a position. However, the most common reason for OCO orders is that it is a good exit strategy. For example, if you have an open position on an asset that you think will fall in price, you can use OCO to profit if the price rises while selling it. (If it goes down from the previous price) actually the level is set first, the order is executed.

Traders looking to limit risk exposure: The ability to set stop loss and profit orders simultaneously minimizes potential risk without reducing trade profitability.

Traders who want to control their emotions while trading: Experienced traders know that controlling emotions while trading is very important. This is true when determining the best entry and exit points in a highly volatile market. Fortunately, the OCO order technique helps traders set a predetermined target, thereby reducing sentiment-based errors.

Traders looking for an operational advantage: Because OCO allows traders to automate order execution and cancellation, they do not need to constantly track price changes or execute trades manually. Since OCO allows the implementation of profit optimization and risk management strategies, traders have free time to analyze other markets or carry out other activities.

How to use OCO order?

You now understand the basics of stop and limit orders. Below is how to combine these two order types to execute an effective OCO order. As mentioned earlier, OCO mandates help with risk management. It is an ideal option for traders who want to determine the best entry and exit points. It depends on the goals of the trader. There are three situations in which the OCO command can be used.

Risk management in open positions

Traders usually place an OCO order when they have an open position. In such scenarios, traders try to protect themselves, believing that the market may turn against them. Additionally, the OCO order ensures that traders do not miss out on profit opportunities when the market moves in their favor. For example, a trader buys Bitcoin at $19,000 with the expectation that the price may rise to $23,000 in the coming weeks. Knowing how volatile cryptoassets can be, the trader can set an OCO order that combines a stop loss order with a sell limit order. . This adjustment reduces risks while ensuring that profit potential is not reduced.

The trader in our example can set a stop loss order if the correction price of bitcoin falls below $17,000. This type of order can be combined with a limit order to sell at a profit when the price of Bitcoin reaches (or rises above) the $23,000 mark. This allows the trader to successfully use the OCO order to maximize returns while minimizing risk.

Target stock price plummets

OCO orders are also effective when the asset price appears to be trading within a defined range and ready for a breakout. This scenario is created after a long period of consolidation, when the price of the asset tends to rise above the resistance level or fall below the support level. An appropriate OCO strategy for these market conditions consists of a sell stop order below support and an entry stop order above resistance. For example, if the price of Bitcoin ranges between $18,500 and $20,000, a trader can initiate an OCO order to execute a sell order when the price of Bitcoin is above $20,000. If the opposite is true (i.e. the price of BTC is below the support), the OCO order executes a stop sale; Better to cut the losses.

Deciding whether to trade between two digital currencies

OCO account is efficient when you decide to invest your limited funds; Especially when you’re stuck between two choices. Please note that the OCO account is not an asset allocation strategy. Therefore, you can invest your capital in only one of the two funds under consideration. Also, OCO Order helps traders base their investment decisions on favorable price conditions. In other words, you can set your OCO account to trigger a buy order when any of your selected assets reach your desired target price.

Let’s look at an example where a trader is interested in buying Bitcoin and Ethereum but doesn’t have enough money to invest in both assets at the same time. In this case, a trader can place two separate buy orders in one OCO starting at specific prices. A trader named Joe will place an entry order for Bitcoin for $20,000 and another for Ethereum for $1,000. These prices indicate how much Joe intends to buy these goods. Since this is an OCO ordering scheme, only one of these orders is used. If the Bitcoin price is the first to meet the condition, the Bitcoin entry will be made while the Ethereum entry will be voided. The opposite happened when the price of Ethereum fell to $1,000 before Bitcoin hit the $20,000 mark.

What does an OCO order mean during a breakout?

Other times, the trader will use the OCO order when the price is fluctuating within a certain range and the trader wants to profit from the next market trend. However, the trader is not sure of the future price action in the market and does not know whether the breakout will be from the upper or lower part of the price range. Therefore, he places a sell order below the support zone and a buy order above the resistance zone.

OCO Ordering Principles

Traders can use OCO orders to trade corrections and breakouts. If a trader wants to trade a breakout above resistance or below support, he or she can place an OCO order that uses buy and sell stops to enter the market.

For example, if a stock is trading in a range between $20 and $22, a trader can place an OCO order with a buy stop just above $22 and a sell stop below $20. If the price breaks above the resistance level or below the support level, a trade is executed and the corresponding stop order is cancelled. Conversely, if a trader wants to use a corrective strategy that buys at support and sells at resistance, he can place an OCO order with a buy limit order at $20 and a sell limit order at $22. When OCO orders are used to enter the market to go, the trader must manually place a stop loss order when executing the trade. The time required for OCO orders should be the same, which means the time frame specified for stop and stop orders should be the same.

Take profit vs stop loss

If the asset you are trading is not in a bear market, many traders use OCO orders to do so. This is because you can predetermine two different outcomes. If the value of the asset increases, a profit can be made. This is known as a “peak profit” order. At the same time, it can be used to reduce risk if the ask price falls. This is known as a stop loss order.

Another situation where a trader can use an OCO order is to buy an asset if it reaches a specific price level in the future and sell it if the same asset reaches a specific price level in the future. Either of these two effects can be adjusted with a single click using the OCO command. This strategy is often used in volatile stocks where price levels tend to fluctuate more.

How to execute OCO orders?

Now that you understand the use cases for OCO commands, it’s time to learn how to execute them. There is no standard procedure for executing OCO, and the process varies depending on the exchange platform you are using. Some exchanges offer integrated user interfaces that provide an easy-to-understand way to set up OCO. These platforms allow users to choose how many types of orders they want to execute simultaneously. Conversely, other exchanges force users to manually set up orders. Exchanges in this category may require traders to create orders independently and combine them to create OCOs. With this in mind, it is important for traders to choose an exchange platform that suits users with their current level of trading experience.

Advantages and disadvantages of OCO Order

OCO orders can be useful for risk management and implementing trading strategies, but they have their drawbacks. Here are some advantages and disadvantages of the OCO command.

Benefits

Risk Management: OCO orders can help traders manage their risk by setting stop losses and at the same time take profit levels.

Automatic execution: OCO orders are automatically executed when certain conditions are met, which can save traders time and reduce the risk of human error.

Flexibility: The OCO order can be customized to meet the trader’s specific needs, such as setting different stop-loss and profit levels for different trades.

Reducing Emotional Decision Making: When OCO orders are made automatically, they help traders avoid making emotional decisions based on market dynamics.

damage

Partial Fulfillment: OCO orders may result in partial fulfillment, which means that only part of the order is fulfilled and the other part is cancelled. This can happen when market conditions change rapidly, making it difficult to fill the entire order at once.

Complexity: OCO orders can be more complex than traditional orders, requiring more knowledge and experience to use effectively.

Limited control: OCO orders give traders less control over their trades than manually executing trades in real-time, which may not be suitable for all traders.

How does the OCO order work?

As mentioned in the introduction to this article, several types of orders are tools that can be used in certain situations. Therefore, each order can create an opportunity for the trader to enter a buy or sell order. Some of these orders can be modified to execute trades under certain circumstances.

OCO orders, which combine “Limit” and “Stop Limit” orders, offer more options for more detailed settings during the order registration process. This way we can prepare for future price positions that may arise in the market.

the last word

OCO Order is a tool that can help traders optimize their profitability. This is especially true for traders looking to trade highly volatile asset classes such as cryptocurrencies. This strategy favors an automated approach to risk management and profitability optimization. The main advantage of using OCO orders is the possibility to combine reverse orders, so there is less chance of serious losses if the market goes against the trade. Additionally, OCO orders generally facilitate trading as it allows traders to follow pre-planned trading strategies.