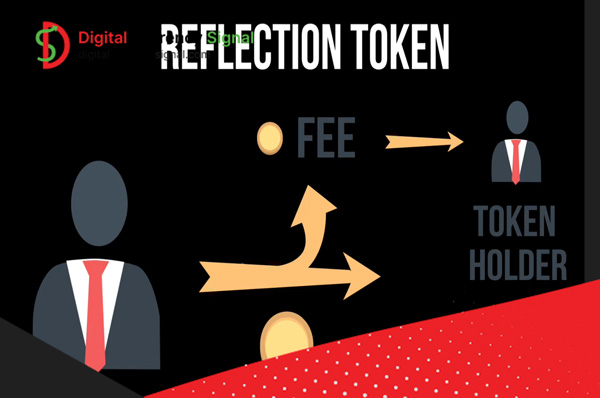

There are many ways to make money in the world of decentralized finance and blockchain. Many are in business and also find various forms of passive income. Currently, the transfer of reflective tokens is becoming a popular solution for passive income. Reflector tokens or reward tokens are cryptocurrencies that reward new token holders in their wallets. This is done using a transaction tax system and a percentage of the collected tax is redistributed to token holders.

Introducing reflective signage

Reflective tokens are also known as reward tokens. Because they pay a portion of the collected fees to the token holders to keep them stable through the reward system. Their performance provides a source of passive income for investors. A portion of transaction fees assessed in digital currency transactions can be passed on to investors who hold reflective tokens. This process is completed through a reflective mechanism that uses smart contracts to distribute tokens to all investors in the liquidity pool. Although this process may seem complicated, it is simpler than mining, storage or agricultural products. Therefore, these crypto tokens make it easier for investors of all skill levels to earn passive income from their holdings.

How do mirror tokens work?

Cryptocurrency markets are notorious for their volatility, often due to traders trying to profit by buying low and selling high. For example, when major cryptocurrency investors buy and sell a large number of cryptocurrencies at once, values can rise or fall significantly in a short period of time. Reflective tokens give investors another way to make money and encourage investors to hold on to their tokens instead of trading them. It promotes market stability and allows investors to make profits; Although they do not have time to constantly monitor the market.

The mirroring mechanism gives token holders a percentage of the transaction fee applied when trading the native token. The distribution is fair to all liquidity pool providers based on their participation in the pool. Smart contracts ensure that the reflection process is fully transparent and executed immediately. A reflection token is also useful for any application responsible for its own underlying currency. This benefit comes from the collection and preservation of funds that can be used to further develop the program and the ability to use a portion of the transaction fee for growth and stability.

Benefits of reflective token

A reflective token not only creates value for all token holders, but also normalizes the market value of the token by encouraging investors to hold it for a long time. As long as the main project remains successful and the volume of token transactions increases, investors can earn passive income without further problems with the token. Unlike staking or farming, where rewards are distributed over a longer timescale, reflective tokens are returned in real time to all token holders in the form of additional tokens.

These rewards can be converted to other cryptocurrency or fiat currencies using DEX such as PancakeSwap, Uniswap and dYdX and more. Crypto-tokens provide benefits to the platform responsible for their tokens as well as their investors. In particular, it benefits new and experienced investors, regardless of the size of the investment. Let’s take a look at the specific benefits offered by these benchmarks.

Market value stabilization: As mentioned above, reflective tokens serve an important value stabilization function, providing financial benefits to investors who hold their tokens.

Weak Income Generation: In order to make a profit from cryptocurrency trading, traders must constantly monitor the market and be ready to trade at the right time. However, tokenization creates a way to monetize the tokens held in the owner’s wallet. There is no need to constantly monitor the market to earn from token tokens.

No steep learning curve: Investors can also be rewarded for holding tokens through staking. Although it seems simple at first glance, it can be a bit complicated on different platforms. Additionally, some platforms require long-term maintenance, making trading relatively unattractive. Purchasing reflective crypto tokens requires minimal effort. Once tokens are placed in an investor’s wallet, they continue to generate income until they are sold.

Fast distribution of profits: each platform has its own sales process; Although many of them only share sales results over a longer period of time. Some platforms require the pool to be kept at a certain size in order for investors to be rewarded. On the other hand, thanks to the demonstration process rooted in smart contracts, demonstration results are generated and distributed in real time.

Hypothetical Valuation: It is impossible to predict the future value of any cryptocurrency. Rightly so, however, because reflective tokens encourage investors to keep their tokens stable while enjoying passive income. So investors are likely to buy more tokens to increase their passive income When this happens The value of the token may increase due to increased demand When the buyer holds their token Although other factors can drive the price of cryptocurrencies, the holding of reflective tokens will put upward pressure on their value.

Disadvantages of reflective token

Despite the obvious advantages of the reflective token, there are some aspects that investors should be aware of before investing. First, the transaction fee or tax applied to these reward tokens can be up to 10% and must be paid for purchases and sales. This requires the tokens to be invested over a long period of time to recoup the transaction tax revenue through rewards or general price appreciation. In addition, the number of distributed tokens depends on the total transaction volume of the local token, which can suffer during bear cycles in the cryptocurrency market. Below we have briefly considered the main negative and dangerous aspects of reflexive symptoms.

Transaction Tax: Transaction taxes are generally assessed both when tokens are bought and sold. This means that you may have to pay business taxes on your initial purchase of the reflector. As a result, every investor starts from scratch and remains in the investment red zone until that tax refund is received. It is reasonable that this process will take at least a few months. Therefore, investing in reflectors should only be based on long-term profits.

Fraud Exposure: Reflection tokens are currently available on decentralized exchanges (DEX). Therefore, investors may be at greater risk of loss due to fraud. One example of a scam to watch out for is called carpet bagging. Because of this potential risk, some investors may initially be tempted to limit their investment.

Returns based on trading volume: Mirror tokens generate money for token holders when they buy and sell local tokens. When digital currency is traded, owners of reflective tokens can earn huge profits. However, if the trading volume is low and slow, the returns for coin holders will be significantly reduced.

A new investment option: reflection tokens are still relatively new to the cryptocurrency world; Therefore, potential risks and issues are not yet clear to investors. Additionally, there are currently a limited number of reflection tokens to choose from.

Understand reflective token methods

In addition to the long-term price appreciation potential of digital currencies, crypto investors often want the option to earn more from their tokens during the holding period. Because the cryptocurrency market can experience price volatility, short-term trading where traders try to profit by selling high and buying low can be a very risky proposition. Similarly, DeFi products that require investors to deposit their crypto assets instead of daily, weekly or monthly income are a viable but fraught option; Such as permanent loss, balance loss and even hack smart contracts that allow fraudsters to steal investment money.

In contrast, reflective crypto tokens or reward tokens encourage investors to hold their tokens; As a result, they promote market stability, while offering investors the opportunity to earn additional income on all ethically conducted transactions. They use an internal fixed reward mechanism that allocates a percentage of gas or transaction costs for redistribution to token holders. This allows token holders to receive more crypto tokens relative to the number of tokens they hold compared to the total token supply. Some mirror tokens allocate a portion of revenue to one or more liquidity pools, often used by decentralized exchanges (DEX) to provide sufficient token liquidity.

The reward system is governed by a smart contract that automatically taxes each transaction and then transfers the same token according to established rules. A smart contract can be configured to update the value of the reflection token regularly or be triggered by certain events or conditions. For example, smart contracts can be programmed to distribute a percentage of the underlying asset’s value to stakeholders on a daily or weekly basis.

Alternatively, it may be triggered by certain conditions, such as the price of the underlying asset reaching a certain threshold or the completion of a certain task. A good contract is responsible for enforcing the terms of the agreement between the token holders and the token issuer. It automatically enforces contract terms without the need for intermediaries or manual intervention. This can help ensure transparent and fair implementation of the terms of the agreement. However, smart contracts are only as trustworthy as the code that enables them. Therefore, it is important that this code is tested and reviewed before deployment to strengthen the token reward mirroring mechanism.

How to earn with Reflection tokens?

By taking a few steps, you can create a passive income stream through crypto-reflective tokens today. The first step is to choose your reflection symbol. Although the variety of signals to choose from is increasing, they differ greatly in key areas. As you consider your options, take some time to review each project’s goals, team experience, and history.

You can also read customer reviews and business reviews. Once you’ve decided which brand you want to own, you’ll need to invest in your purchase. These tokens are usually traded in stablecoins or major digital currencies such as BTC and ETH. If you don’t have any cryptocurrencies, you should first buy them from an exchange like Bybit. You will also need to create a wallet to hold the tokens if you don’t already have a crypto wallet.

To invest in a reflective token, exchange digital coins for the tokens you are interested in. This can easily be done through an exchange platform. Note that the exchanges offer only certain crypto pairs. You should research exchanges to find one that offers the token you want to buy. When you purchase your tokens, you will be responsible for paying transaction fees. However, once your tokens are in your wallet, you can start earning rewards. Beyond owning your tokens, you won’t need to take any other steps to qualify for rewards.

Reflexive tokens or hyperdeflationary tokens?

Although these two types of indicators are similar, inflationary indicators have subtle differences that distinguish them from hyper-deflationary indicators. Tokens control token management by distributing tokens as rewards to long-term investors, thus encouraging more tokens for long-term use. On the other hand, hyper-deflationary indicators are shown to have devastating effects on the economy by burning intellectual property rights. As a result, hyper-deflationary signs try to raise prices by burning signs. While the light indicator directly rewards the owners of the gas share that is distributed among them.

The biggest difference between the two types of cryptocurrencies is the way they create value for investors. Hyperdeflationary tokens such as BNB, XRP, and Polygon, among others, use various token burning mechanisms that appear from time to time to gradually reduce the available tokens. As a result, the token price is expected to rise as demand exceeds supply, creating positive capital gains for token holders in the process. Reflective tokens rely on their own reward mechanism to continuously reward investors, while supply costs are kept low by smart contract-driven token burning rates.

Both tokens incentivize their token holders for the long term. Reflection tokens offer a better value proposition through a reward mechanism. In effect, Mirror Tokens combine the scarcity benefits offered by hyper-deflationary tokens with the prospect of continuously earning rewards as long as token trading grows at a healthy rate.

Many popular reflective tokens

The profitability of your investment in reflection tokens largely depends on the tokens you invest in. Everything from the initial transaction tax you pay to your distribution structure, trading volume, and more affects your profits. With that in mind, it’s best to learn a little about the best meditation tokens.

EverGrow

EverGrow Token or EGC is one of the newer options available, but thanks to its generous mirror system, it is already attracting a lot of attention from investors. Specifically, all EGC transactions are taxed at 14%. The instant distribution amount for mirror token holders is 8%. Unlike other mirror token platforms that pay rewards in the base token, EverGrow Coin pays rewards in BUSD. Notably, EverGrow Coin paid out more than $35 million in token rewards just a few months after launch.

Think about finances

Another reflective token to consider is Reflect Finance, or RFI, created on the Ethereum network. All RFI transactions are subject to a 1% fee, which is distributed directly to token holders. The distribution of tokens depends on the situation of each investor. It is worth noting that RFI token holders can continue to earn passive income while earning income from exploitation or farming.

Lucky Block

Lucky Block has a unique concept that gives users a chance to win daily rewards just by holding some NFTs and participating in tournaments. Lucky Block is based on giving every ticket holder a chance to win the lottery. Once an NFT is purchased, it entitles users to participate in a tournament hosted on the platform and part of the gambling pool.

Bonfire

Bonfire’s main goal is to create a decentralized virtual world. Bonfire was founded in April 2021 and has a total of one quarter billion tokens. All Bonfire transactions are assessed a 10% fee. This cost is split equally between reward and redistribution.

Are reflective tokens worth the investment?

For investors looking to invest in cryptocurrencies but at the same time earn a return on their holdings like fiat currencies, mirrored tokens can be perfect for such balancing purposes. However, they are subject to the same price fluctuations as other digital currencies, which should be taken into account when deciding whether to buy or sell. In general, mirrored crypto tokens can be a good investment, but there are risks involved.

for example, The total value of the token may decrease due to market fluctuations, which may affect the investor’s balance sheet and cause a total loss of value. Token holders must pay an upfront transaction fee when purchasing tokens. Depending on factors such as trading volume and profit levels, it may take several months or longer for a token holder to break even on their investment and make money. With this in mind, Reflection Tokens are a good investment for those who plan to hold the tokens long-term. Passive Income can be maintained with your tokens. In addition, Depending on price volatility, investors need to decide when to finalize their token sale based on market value.

Remember that the time it takes for the collected rewards to clear the tax on the value of any purchase or sale can vary depending on the popularity of the project and general market sentiment. Investors would do well to investigate the use cases of a blockchain project that provides a signal to show and only invest in assets that do not show carpet signals. Therefore, investing in indicators requires a bit of involvement to understand the vision of each project, the past success of the group that launched it and whether Tokonomics can improve the environment. However, it can be very profitable for long-term investors who can ride out short-term market fluctuations without selling their positions.

How to buy reflective token

Buying Reflection Tokens is as easy as buying any other digital currency. Investors typically need an active crypto wallet to hold reflective tokens using major digital currencies such as Bitcoin (BTC) and Ethereum (ETH). They can then switch to a dedicated exchange platform that allows users to trade BTC, ETH and other supported commodities. After deducting the transaction tax and any applicable exchange fees, the purchased reflective tokens will appear in the user’s wallet in place of the redeemed tokens. Investors can then receive rewards in these reflection tokens and do not need to take any other steps to qualify.

The future of reflection tokens

Despite being less than two years old, reflective tokens are still a relatively new concept in the world of digital currencies and are gaining more and more priority among cryptocurrency investors. While token holders are motivated by an immediate and transparent reward mechanism, developers looking to create community-driven projects are attracted by the potential to create sustainable ecosystems that can power future Web3 platforms.

However, as seen with other forms of digital currency such as stablecoins, memecoins and other altcoins, reflective tokens will also see natural integration, with some projects performing better than others. Investors should carefully select projects with solid fundamentals. Meanwhile, developers must strike a balance between affordable transaction fees and a healthy redistribution reward mechanism for token holders.

While some proponents believe that Reflection Tokens could see wider retail adoption than other asset classes in the crypto world, critics have pointed out that the increased complexity of the contract code smart may limit the number of cases that can be used. Therefore, the future development and success of crypto-reflective tokens depends on the speed of smart contract innovation and the increase of investor acceptance of this type of digital currency.

Research and presentation

Tokens generate income and many crypto projects use this method to attract users and investors. However, it did not last long. Make sure you do your research before buying a reflex coupon. Also, before paying money in any way, do your research and learn about their legitimacy and credibility. In general, no matter how promising the project is, never invest more than a certain amount.I hope you enjoyed the What is a reflection tokens article