In this article we will try to find a complete answer to the question of what is a blue chip. We will introduce and explore the deep connection between blue chips in the traditional investment world and the cryptocurrency world and explain this connection in detail. As you know, the presence of inflation in all countries of the world leads to the fact that people’s lives are faced with serious problems. The emergence of inflation forces financial market investors as well as ordinary people to try to protect their money with the right foreign exchange solution. Bitcoin seems to be one of the best ways to store the value of money. In today’s world, Bitcoin has become a safe haven for storing the value of money. This safe haven has its own governance rules that differentiate it from other cryptocurrencies and other asset types, and its secure environment attracts many people.

What are blue chips?

It is better to know that blue chip has different meanings in Persian language. In the Persian language, it is known by names such as Blue Chip, Blue Chip and Blue Chip, and even Blue Stock; Blue Chip can literally be said to be a type of casino currency that actually represents the value of an asset, but the term entered the world of traditional finance to be used as stocks with low investment risk from casinos. ..

The most important thing about Blue Chip is that the effectiveness of Blue Chip is not only limited to stocks and assets, but also in the financial market of any activity, market or company that can maintain its stability and even grow in difficult economic conditions. . If it continues and does not fail, it is considered a low-risk activity.

One of the best examples of blue chips are energy companies. As we said above, Blue Chip is not only limited to assets, but Blue Chip can also be found in energy companies; Even when economic growth is at its lowest level and oil and gas markets are in crisis, these companies will maintain their stability.

Blue Chips can be found because these companies can continue to operate even in the worst economic conditions in the country, maintain their share prices, and see the stocks of these companies rise even in the worst conditions. inside. these companies.

blue stick example

To better understand the topic of this article, what is a blue chip? Let’s look at a very simple example:

Our energy company of choice is the Energy Select Sector SPDR Fund. This fund in Waja is a place for those who want to invest in this area and provide detailed information about the return of this market and people can get detailed and complete information from this fund. This market shows energy prices and sector energy efficiency indices before costs; After the S&P 500, this index seeks to provide investors with an efficient presentation of information about companies in the oil, gas and consumer fuel, as well as energy equipment and service sectors.

In 1998, the Energy Fund was created; In these years, this fund has had difficulties and economic problems such as the collapse of Dotcom, the crisis of 2008, the epidemic of Covid-19, and now other events that have increased in addition in the world. These conflicts can be considered as one of the biggest economic problems. .to think

This fund faced many problems, but despite all the problems and economic problems, it made a return of more than 224%, and even in economically difficult times, the rate of return did not fall below the target value, and the activity I was able to continue. Despite these problems, the company was able to recover its capital in a short period of time.

The example we describe in this section by analyzing the blue chip; This fund is a clear example of a blue chip in an investment portfolio because we know that energy is something the world will need; Therefore, the share price of this fund is always rising and the demand is increasing.

The example you saw in the previous example is repeated here with the Energy Recovery Inc index and can be found in this appendix, this index is listed on NASDAQ and focuses on the production of energy recovery equipment in the gas field. , chemical and water industries all over the world. If you review the chart of this company, you will realize that its shares have grown even during the most severe economic crises and have not seen record values.

How is Blue Chip doing in the crypto world?

The examples that we mentioned in the previous part in the field of stock exchange happened in traditional markets, you may ask if they are repeated in the world of cryptography?

In response to this question, by observing the close relationship in behavior between the traditional market and the world of crypto finance, it can be concluded that the answer to this question is positive, it is better to know that Bitcoin is known as the biggest blue chip of the crypto world .

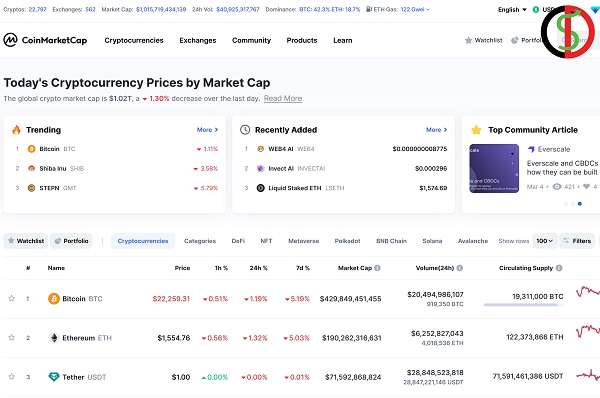

Next, listen to the picture of Bitcoin and its value:

This chart is known as the oldest Bitcoin price chart since July 5, 2013 and has not changed in these years.

If you pay attention to the beginning of Bitcoin and its development to date, you will see that this chart does not give false information and the process of growth and analysis of BTC has never turned red. Although this currency has faced many ups and downs in its price trend, it has always respected its old price. To better understand this issue, consider the following example:

If an investor bought $1,000 worth of bitcoins on July 5, 2013, he would have a total of 15.26 bitcoins, which would amount to $350,132.46 in August 2022, according to the price chart. Pay back this investment in 9 years. Over 35,000%, a rare achievement in the world of traditional finance.

It should be noted that fluctuations in the financial markets have led many market analysts to believe that Bitcoin and other cryptocurrencies cannot be considered blue chips because these assets are highly volatile, which prevents them from being considered as low-risk investments.

Currently, many researchers in their calculations do not take into account the fact that the world of crypto is different from the world of traditional money and do not take into account this important fact. In this article, we are not talking about companies or stocks, but about technology that seeks to create money that works well. Our goal is this, it is good to know that this money can create new digital relationships between new markets.

Finally, it can be said that the rules of the traditional world and its measuring units cannot be applied 100% to the crypto market, the best reason for this logic is the Bitcoin price chart.

Are blue chips safe in the bear market?

We currently view the cryptocurrency as a blue chip, but note that this does not mean that the asset will not be affected by bear markets.

Cryptocurrency prices are often affected by bear markets, and in this area you can consider Bitcoin as a famous example. After rising to 68,789.63 dollars in November 2021, this coin was traded in the range of 21,000 dollars, but if you look at the current price, you can see that its value is now less than a third of its value, however However, those in two They invested this money last year and are more than 70% profit!

The example we mentioned above can be applied to all major cryptocurrencies on the market. In general, all of them were affected by major bear markets; Of course, keep in mind that the cryptocurrency market is not the only market affected by the downtrend in the world, but traditional markets are also a reflection of this trend and are affected by the downtrend of the market; Even global currencies like the Euro and US Dollar are affected by inflation and bear markets and may see a decline in value.

From all that we have mentioned, it can be concluded that the blue chip is safe from all bear markets and never fluctuates. A trader or investor cannot be 100% sure that a stock or crypto asset will not crash.

When investing in the stock market, you cannot be sure that the value of your property will go down, because in any type of investment, there are always risks that you should consider and you should not always trust the market.

The most important point of this section is that when talking about a stock or coin with a low level of risk and the probability of risk being seen as very low, it clearly means that “the stock in question will probably explode, but there is .factors that do not cause or prevent it from happening” where these factors define the difference between good and bad stocks or reliable and unstable coins.

A study of investment risk and factors involved in risk

To better understand investment risk and factors involved in risk, consider the following example:

If we are in a bear market and our eyes are on two companies, in a downtrend the prices fall gradually, but in the case of these companies, Company A does not take steps to diversify its market. However, they do not take new products or steps to reduce costs and prepare their accounts for such conditions, and make no effort to keep themselves at a higher level.

Unlike Company A, there is Company B, which is not only rebuilding its structure for those bad times, but also wants to develop new products for new markets, Company B is able to offer more products and options and increase operations. itself to survive in these conditions, and it seems that this company continues with all its strength against the price market, unlike A.

In addition to trying to increase its operations in different markets, to increase growth and take advantage of market conditions, Company B, which makes a significant effort for stability, will do its best to avoid failure in declining market conditions.

Now is the time to ask yourself, does company A have the opportunity to hold its value or does company B? Which one is safer to invest in and can bring you good profit? Company B is definitely the answer to our questions and the reason is very clear.

Although the market is down, the company is trying its best to overcome the down market and is more stable than company A in this situation, this also applies to the world of cryptocurrencies and its cryptocurrencies.

Crypto project

In the cryptocurrency market, projects like Bitcoin and Ethereum have always continued their creativity in development and innovation and moved in this direction. Whether in the crypto season of 2018 or now, they continue to strive to improve technology, provide better access and increase usage.

Factors such as the fall in the value of Bitcoin, Ethereum or common crypto projects do not always stop their team from developing the project and its technologies, they are always trying to recover lost things and overcome them in this lower market.

It is better to understand that in the financial markets, there are always cycles of falling and rising because this market is always subject to many changes and periods because crypto projects continue in this spirit of stability and growth. ; They are considered blue chips. This issue also applies to the traditional market and cannot be excluded from the traditional market because, as we said at the beginning of the article, blue chip traditional markets are also included.

If we want to come to a complete conclusion, we can say that, in fact, everything depends on the performance of crypto-coins and companies, how they present themselves and how resilient they are, only this will enable them to collapse markets. And tough economic conditions remain in the market.

Always remember in the financial markets that it is impossible to choose a 100% safe stock or cryptocurrency, because in any case they are also affected by bear markets and economic sectors in the short term, and change- Don’t let these change. it is certainly Talk about it safely; But what you can do is research and watch carefully when investing in the stock market and crypto, so that you can find the best option.