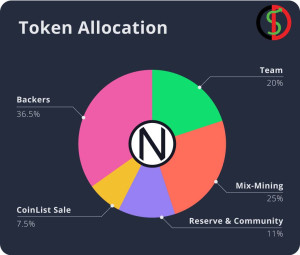

One of the most important aspects of the token economy of digital currency projects is how tokens are distributed; called vesting. Most of the time, blockchain projects have determined specific plans for the distribution of tokens and do so in several stages. The token distribution schedule and method directly affect inflation and token value. Crypto project developers want to preserve the value of project tokens by incentivizing them to maximize user participation in the project. Therefore, you must have accurate and fair inflation and user reward mechanisms. In this article, we want to define vesting crypto, so stay with us until the end of this article.

What does vesting mean in cryptocurrencies?

Vesting In traditional finance, vesting is a legal term that means giving or receiving a present or future right to a payment, asset, or interest. This phrase is very different from what is said in the crypto world. In digital currency projects, vesting refers to the process of distributing or holding tokens according to a predetermined schedule. Usually, Vested Tokens belong to project members, business partners, and those who have contributed to the development of the project. In addition, some of these tokens will be sold to initial investors during the initial public offering process.

What is the importance of Vesting a token release?

Years ago, some tech startups offered their employees a piece of the company’s stock. But the employees could not sell these shares for a certain period, or at least they could not sell all the shares at once. This method was used to retain employees and increase their interest in the company’s development. Because they have not been able to sell the stock for years, the stock price has not fallen as a result. The main and decisive reason for Vesting is that project shareholders do not sell their cryptocurrencies on the market at the same time and do not cause the price to fall. Vesting delays the transfer of full ownership of tokens.

The first and most important benefit of vesting in token releases is reducing the risk of market manipulation. That is, project owners and future investors ensure that the original investor or project developer does not quickly sell their assets or create artificial scarcity by hoarding the token. Also, by postponing the complete transfer of ownership, the project is exempt. Fair distribution helps prevent large portions of project tokens from being awarded to one or a few people at once.

What is meant by vested tokens?

Although the tokens are not unlocked and there is no possibility to sell, these tokens are said to be wasted. It is better to know that these tokens will be created and eventually circulated, but they cannot be withdrawn, transferred, or sold before they have been unlocked based on the digital currency schedule. A large portion of brand-new projects are mostly wasted. When tokens are unlocked and released into circulation and the ability to sell them, they are called allocated tokens.

Why is Cryptocurrency Vesting Important?

After the IPO or fundraising period, the pressure to sell tokens increases as project owners or early investors sell their tokens. Therefore, the value of the brand has decreased, which is not good for the whole project. If retrieval does not occur, individuals or small groups can keep large amounts of tokens for themselves. Vesting digital currency prevents inflation and unfavorable fluctuations in token prices by synchronizing token distribution and creating restrictions on the sale of large amounts of tokens allocated to initial investors and development groups.

How will TokenVest affect token supply?

In short, vesting allocation leads to an increase in the circulating supply of a token. However, investing in tokens should not be confused with crypto inflation. A process that sees the total supply of tokens increase as the circulating supply increases. Token allocation only changes the circulating supply. Often, only a small portion of the maximum resource is open for circulation in TGE. In some cases, the initial supply may be less than 1% of the total supply, which means that the token allocation may result in a significant increase in the token supply during the allocation period. As you might expect, when an increase in supply is not matched by an increase in demand, it can lead to a decrease in the value of the token.

5 Advantages of Crypto Vesting

Cryptocurrency investing only exists because of the many benefits it offers investors, token projects, and token developers.

1.This reduces the risk of market manipulation

Vesting ensures that no early investors or project developers rush into the market once the crowdfunding period is over. They also cannot handle token hoarding by token supply and create artificial scarcity. Reducing the risk of market manipulation makes it easier to identify scams that generate worthless coins after receiving funds from investors.

2. Strengthens commitment

Crypto allocation works by delaying the release of the project’s tokens to the owners, creating flexibility and commitment to see the project grow into what it was designed for. This gives the incentive to stay and play a long game, with the guarantee of a reward after a long wait.

3. Tokens promote decentralization

The goal of crypto vesting is to create a secure decentralized crypto network, which takes time. This gives the developers much-needed time to do more work on the intrinsic value token.

4. This reduces the risk of market fluctuations

Vesting helps distribute tokens to ensure that most of a project’s tokens are not owned by one or more unscrupulous individuals. This small individual or group can easily change market supply if unchecked. These market fluctuations damage the token’s value and harm retail investors.

5. Great investment opportunity

Crypto investing allows you to invest in cryptocurrencies while retaining ownership until you sell or trade them. When you participate in the ICO of a token you have a purpose, therefore you become the first investor to qualify for their tokens. These tokens can be sold later, giving you a good return on your invested capital.