We will provide you with information about digital currency swapping and analyze the reasons for digital currency swapping and tell you what happens in the digital currency swapping process. The digital currency market has become prone to creative and new measures to perform simple and integrated tasks of managing, storing, purchasing, and using digital assets, which directly improves the user experience and the complexity in this area. The digital currency market is a new and developing market that includes many rules and concepts. To operate in this market, you must first get the necessary training and become familiar with the rules and concepts that are common in the market so that you do not have problems.

One of the most overused terms in the cryptocurrency space is digital currency swapping. For this purpose, in this article, we try to provide you with information about cryptocurrency swaps, examine the reasons for digital currency swapping, and try to introduce you to the best swapping platform.

What is a digital currency swap?

If you are active in the digital currency market, you might have heard the name digital currency swapping and want to know about this concept, maybe you have this question, what is digital currency swapping? In answering this question, we can say that the word “swap” means change and exchange, But in general, a swap is a type of agreement in the form of an exchange, which is signed by both parties to the transaction, and both agree to pay money at the time specified in the swapping agreement. These specified times in the digital currency swapping contract can be yearly, monthly, or…

It is interesting to know that there are two different definitions in the field of digital currency swapping cryptocurrency. The first definition is a way to quickly convert digital currency into another currency without the need to convert digital currency into fiat currency. This explanation covers how well-known protocols like Shapeshift, Changelly, and Airswap work. On the other hand, the second thing that exists for digital currency swaps is the transfer of platforms or protocols from blockchain to another network and it is the definition of token exchange requirements that is often associated with this movement. In this definition, a project decides for some reason to transform its operating base into another blockchain, creating a unique token standard.

Reasons to swapping digital Currencies

As we said, digital currency swapping means converting digital currencies into other cryptocurrencies to gain profit and satisfy demand. Also, many people swap their digital currencies on different platforms. There are many reasons for digital currency swaps. For this reason, in this part of the article, we will try to examine the reasons for the swapping of digital currencies.

- One of the reasons for digital currency swapping is profitability. Because the price of digital currencies changes quickly, you can create a lot of profitable trading digital currencies. That way, if you time the market right and have a bit of luck, you can make a lot of money trading digital currencies at the right time and a good price.

- Another reason for digital currency swapping is to exchange investment funds. Portfolio diversification is usually a good way to deal with the risk of price fluctuations. Having a small number of different cryptocurrencies can reduce the impact of the decrease in the value of the digital currency without causing significant losses to the trader.

- Another reason for swapping digital currencies is passive income. Some digital currencies are staking, which means you can get a large amount of that digital currency as profit by locking a particular digital currency to its appropriate platform without doing anything else.

How is a token swap done?

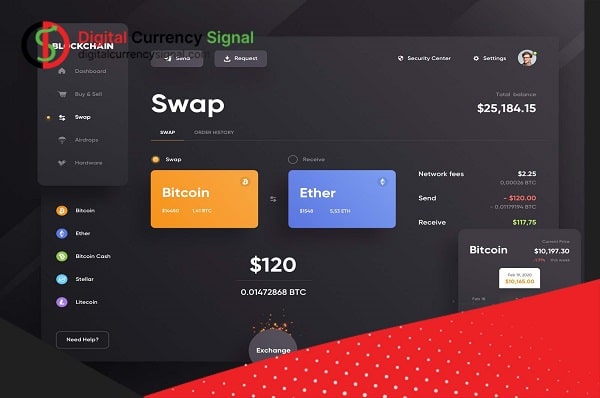

If you use an exchange to swap tokens You may not notice any changes. Most digital exchanges have a swap function, and their simple user interface allows you to use this process without any particular difficulties. On the other hand, if you store your tokens in a digital wallet, it will be a bit more difficult to swap them, because usually the transfers depend on the desired networks and you need to make sure that your wallet can transfer.

Types of crypto swaps

1. swapping through exchange

Swapping crypto with the help of an exchange is one of the most common methods used by users. In this way, you must register with the exchange and confirm there. After that, you need to add an account or transfer cryptocurrency to the exchange’s wallet address. After doing the above, you can exchange your cryptocurrencies for other digital currencies.

2. swapping on a decentralized exchange

Decentralized digital currency exchanges do not store users’ assets on their platforms. Instead, you send your currency to the swap and they convert the desired currency and finally send it to your wallet.

3. swap in the ledger wallet

To reactivate your ledger wallet, you must first purchase the wallet and then download the Ledger Live app. Unlike most digital swaps, after the swapping process, the funds are transferred to your wallet and the assets are in your hands.

4. Atomic Exchange

Atomic exchange or atomic swap is a method of direct exchange of cryptocurrencies, so there is no exchange intermediary. When performing atomic swaps, control of private keys will be fully available to users.

What are the important points of swapping?

One thing to note in Swap is that due to the growth of Swap services, it is very important to do the necessary checks before choosing one of them. The things to pay attention to are access to a wide selection of cryptocurrency pairs, the strength of the platform’s security, and the speed of currency exchange. Note that high speed eliminates the chance of falling. Slippage occurs when the amount of digital currency A received against another digital currency (as a result of price changes) decreases drastically before the transaction is completed. Some services compensate for this reduction by offering a fixed exchange rate that is maintained from the start of the transaction until its completion. The only additional condition of such offers is that you pay a higher transaction fee.