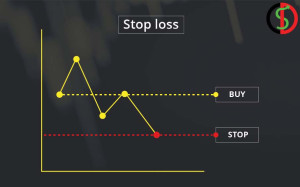

Stop loss is a safety valve to protect traders against cryptocurrency loss. This service (feature) is used by traders who work in the financial markets with a short- and medium-term perspective to determine the right time to exit the transaction. These people use Stop Loss to stop losing trades or to set their profit and loss limits. Of course, sometimes a stop loss order can operate at a profit or even at a zero to zero point.

What is the stop-loss?

Such is the nature of trade that is directly related to merchant capital and there is much excitement. And often even experienced people fall into the trap of these emotions and make decisions based on emotions. When a trader acts on emotions. If the scientific rules of trading are not observed, the level of trading risk increases and in most cases leads to significant losses. Setting a stop loss helps traders determine favorable conditions for a trade before entering it and avoid further losses if conditions do not meet expectations.

Therefore, stop loss or stop loss is the point at which the trader decides that the trade is profitable and it is better to cancel the trade. It should be noted that manually setting stop loss is not a recommended task and various programs and software are available to set stop loss. Even in many exchanges, this feature is available to automatically set the user’s stop loss, thereby avoiding large financial losses and further loss of capital.

Why is stop loss important in digital currency?

Knowing stop loss is important in all financial markets because using stop loss prevents users from increasing their losses in trading. Suppose you made a transaction to buy a digital currency token in an uptrend and hope to make a decent profit by increasing the price. But due to the reasons which may be the release of bad news for the cryptocurrency market or some other event, the price starts to fall.

This news can be so surprising that this discount reaches as high as 30 and 40 percent. In such a situation, if you have not set a stop loss for your transaction, you will incur a huge loss. In the digital currency market, knowing the stop loss is two important for traders and traders. This market generally experiences more volatility than other financial markets such as the stock market and the possibility of high percentage losses is much higher in this market.

In addition to determining the importance of using a stop loss, the volatility of the digital currency market can also affect the stop loss decision. Placing a small stop loss in a volatile market can cause a trader to stop all trading. Therefore, it is important to pay attention to both of these things to determine the stop loss in digital currency.

Different types of stop loss?

1. Full Stop Loss

This method locks all crypto assets that have been launched and are only useful in a stable market with sudden and unexpected price changes, so the price drop is expected to remain low. If cryptocurrency prices remain low, avoid losses. It’s a black-and-white strategy; In a sense, there is no middle ground. Therefore, when setting a stop loss order, the trader needs to consider the risk and profit of both scenarios. For example, you have a Bitcoin and you are worried that when you wake up tomorrow, its price will fall below its current value. This way you set a stop loss and tell the exchange to automatically sell bitcoin when the price of bitcoin falls below a specified amount.

The advantage of this mechanism is that if the price falls below a certain value, you liquidate your asset and have not suffered more losses than you want, and you can buy again later when the price drops.

2. Partial Stop Loss

This method liquidates a certain amount of digital assets. This method can be useful in a highly volatile market to ensure that the trader has funds if the price falls before it rises. In this case, you decide that only 50% of your property will be sold if the price falls below the set limit. If the price later rises above the set limit, you can at least benefit from the price increase with half of the remaining bitcoins. In this case, you will have more flexibility for your next move.

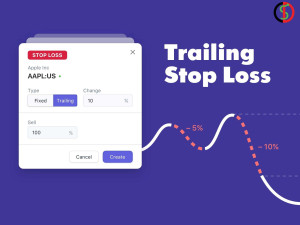

3. Trailing Stop Loss

The trailing stop is a special type of stop loss that moves automatically and in sync with market changes compared to the limit we have specified for this transaction in order to increase the profit of the transaction to’ r user In other words, the trailing stop helps users to identify the best buying and selling points so that they can get better trading conditions.

A trailing stop can be considered short or long depending on the position the user takes, which is placed at a certain distance from the current price of the relevant currency in the market. If the price of the target currency rises in the market, this zone also moves with the change in the price of the currency, but if the price of the cryptocurrency falls, this range remains unchanged, and if the price of the currency falls to the price of the currency. a target transaction in the trailing stop range is more profitable than in normal cases. it closes

✅Conclusion

Today, the digital currency market has become one of the most popular areas of investment. But entering this area and the stock market requires adherence to certain rules and principles. Choosing a stop loss at the right time is one of the things that every trader should pay attention to avoid large financial losses. In this article, we introduced you to this concept, its importance, and how to choose the right stop loss. We hope you fully understand what a stop loss is.