If you are active in trading and selling digital currencies, you are probably familiar with the concept of staking or have heard of it at least once. A digital currency stake is a way of validating transactions across multiple blockchains that allow participants to earn rewards based on their holdings. But what is staking and what does staking of digital currency mean?

Not all cryptocurrencies are capable of offering staking. For example, Cardano and Tron are cryptocurrencies that have the ability to staking. Staking is a process that can be compared to Bitcoin mining. except that it requires very few resources. While Bitcoin uses Proof of Work (PoW) for its consensus mechanism, Other popular coins like Cardano, Neo and Ontology use Proof of Stake (PoS) mechanism.

What is staking?

In the world of digital currency, staking refers to the distribution of digital currency to the network in exchange for a reward. If you are looking for a way to generate passive income without spending a lot of time and energy, you can stake or invest in digital currencies. Digital currency staking should be considered an alternative solution to the mining process and consumes much less processing and electricity resources. One of the main advantages of staking compared to mining is the ability to enter with much less capital; You will earn digital currency without having to pay the exorbitant costs of setting up a mining rig and while also consuming a lot of electricity.

When you stake a digital currency, you actually plug into its network, review transactions, and add new blocks to the blockchain. The same thing mining devices do on coin networks like Bitcoin and Ethereum. Of course, in staking, nodes are called validators instead of miners.

difference between holding and staking currency

At first glance, handling looks similar to handling, but there are important differences. After Staking, unlike Holding, your assets are locked and you can no longer use them freely. Of course, nothing will be added to your property by depositing. However, by staking, in addition to receiving the same digital currency reward, you will also help ensure the security, efficiency, productivity and decentralization of the coveted cryptocurrency blockchain network. To better understand the difference between holding and stacking, imagine that your current investment strategy, based on fundamental analysis, is to buy Cardano and hold it for a few months.

How does staking work?

As mentioned, during the verification process, the devices take on the task of mining the digital currency. In fact, the first person to create a new block will be rewarded. In such blockchains, the competition will always be more for processing power. For staking and proof of stake, the case is slightly different. Since the user doesn’t do much to validate the transaction. In fact, this network is where you choose a person to mine cryptocurrency. First in this process you buy and lock in some original digital currency of the block. The blockchain will then randomly select one person to approve the transaction. The person selected as the researcher will receive a reward. The important point is that people with more digital currencies have a better chance of being elected. In this case, you have to compete with others on the network. In this case, you are not competing with the processing power and amount of mining equipment. The competition in the staking process will be based on the amount of digital currency.

Cryptocurrency stacking methods

There are different methods of staking cryptocurrency. Examples include cold stacking, Locked stacking, and flexible stacking. We will look at these solutions below.

1.Locked Staking

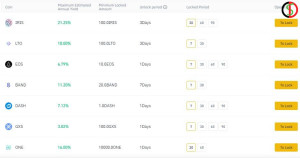

Lock staking is the holding of assets in an exchange wallet to support the blockchain network. As long as the currency is locked in the exchange wallet, you will earn interest. As soon as the money is withdrawn from the wallet, the interest will also stop. Each cryptocurrency has a unique waiting time. In case of requesting a withdrawal of the locked asset, the desired digital currency and its profit will be credited to your wallet. Below is a list of digital currencies with locked staking features on Binance Exchange.

2.Flexible Staking

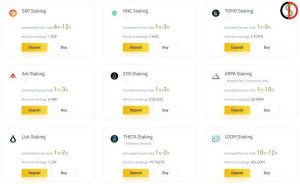

Similar to the locked-in approach, flexible solutions also include storing money in digital wallets. The difference between this method and locked staking of digital currency is that there is no need to lock the funds. In this case, the user will be able to trade with the asset even if it is a stack. Obviously, you will make a small profit this way. Some of the tokens that support flexible staking on the Binance exchange can be seen in the image below.

3.Cold Staking

Cold staking is a subset of the locked method. This solution involves storing cryptocurrency assets in a cold wallet. A cold wallet is a wallet without an internet connection, such as a hardware wallet. The more capital someone has for a stak, the more they will want to use the cold process. Suppose an investor wants to invest several million dollars in Cardano. Shouldn’t he be worried about maintaining this huge capital in currency? Several blockchain networks offer offline staking. This method is more secure. As long as the stacker keeps his assets in the same wallet. he will be rewarded. In case of transfer, the bonus stops.

How to Calculate cryptoCurrency Staking Rewards?

It is not possible to give a definite answer to this question. Because each network calculates rewards based on its own factors, but in general, blockchain networks based on proof-of-stake algorithms consider the following factors among their factors:

- The number of coins stored by the node

- How long does a node store coins for?

- The number of coins stored in the network

- Inflation rate and…

Staking is a viable alternative to proof of work mining That makes you earn money just by investing without the need for additional costs such as the purchase of mining equipment and high electricity costs and avoiding the high noise of mining equipment. This method has provided a new way for people interested in blockchain and digital currencies to easily earn rewards simply by joining a decentralized network and contributing to its security. Remember that the investment process is not risk-free and is completely win-win. Holding assets in smart contracts has its own drawbacks. So if you decide to get involved with your cryptocurrencies, be sure to choose an exchange or wallet with high security for this purpose.

What coins can be satking?

Until the last few years, the concept of a bet confirmation mechanism was not well established and the bet options available were very limited. There are several options for staking cryptocurrency, although some networks currently follow a proof-of-work mechanism. Below is a list of the most popular proof-of-stake digital currencies:

Ethereum (ETH)

Ethereum has become the most popular cryptocurrency in the world after Bitcoin. Users must have at least 32 Ether to invest in this digital currency. The return on shares in this digital currency is considered to be between 5 and 17 percent per year.

EOS

Like Ethereum, EOS is used to support decentralized applications. The native token of this blockchain is EOS, and like the other cryptocurrencies on this list, it is considered a staking currency.

Tezos (XTZ)

Tezos is an open source blockchain network with native token XTZ. The current expected rate of return for Tezos shares is around 6%.

Cosmos (ATOM)

Cosmos calls itself the “Blockchain Internet”. The team behind this project hopes to bring together different blockchains and allow them to interact. Coinbase, Binance, and Kraken support ATOM shares.

Cardano (ADA)

Cardano is a smart contract platform similar to Ethereum, but with a multi-layered structure. Binance supports ADA staking with returns of up to 24%.

Polkadot (DOT)

Polkadot is a new cryptocurrency that was created in August 2020. Polkadot, like Cosmos, intends to enable the interoperability of various blockchain networks. Crypto exchange Kraken supports investment for DOT.

What are the terms for staking cryptocurrency?

The most important point is that the blockchain in question uses a proof-of-stake mechanism. The terms of use of staking services are clearly defined. The individual staking rules are:

- The wallet must be online 24/7 (unless you use cold staking).

- Wallet must support staking.

- It usually takes a few days for your coins to expire before you get your investment reward.

- A minimum can be set for the amount of coins required for the stake.

Each blockchain has different rules. So it’s a good idea to do a little research to find the rules for each coin. You can leave your computer connected to the internet 24/7, buy a virtual private server, or use a service that offers staking services. In the first two methods you check your function keys yourself, but in the last method this is usually not the case.

What are staking pools?

Staking pools are essentially groups where coin holders pool their holdings. Coin holders have a stake as a single investor and thus have a higher chance of being selected as a validator and reaping the rewards. Rewards received are distributed proportionally and based on the amount of coins each participant has deposited in the group account. Since organizing and maintaining a pool requires significant resources, pool providers charge participants a fee that is deducted from their share of the reward.

Of course, the flexibility and capabilities of these pools have offset this additional cost to investors. Contributing as an individual requires meeting the minimum coin lock time and minimum balance required for a particular project. All these things can strengthen the stacker. Stacking funds, on the other hand, generally have no withdrawal time limits and allow the depositor to participate in the stacking process with very little initial balance.

Why is staking profitable for investors?

Investors have turned to staking as their main source of investment income. Although staking is different from mining, it is gaining popularity among cryptocurrency holders. Staking is very different from the traditional investment model, as investors earn interest on an annual basis from their accumulated coins.

1. A reasonable and profitable purchase

Cryptocurrencies are also generally more secure due to their hidden hash count and algorithms that intelligently identify hackers and can completely remove them from the system. staking is a great source of income for people who don’t want to get involved with the volatility of the cryptocurrency market.

2. Better than day trading

Staking is a better method compared to day trading because it eliminates daily fluctuations. This phenomenon has also caused digital currency startups active on various blockchains to create new competition by entering the market in this field. As the situation in digital currencies improves, more investors and purchases enter the market, especially in countries with high inflation. For some people, the best investment is cryptocurrency and related technologies.

Day by day and year after year, more and more progress is being made in the cryptocurrency industry and wealthy investors with analytical skills and knowledge about the world of cryptocurrencies are financially superior to others. Don’t miss the opportunities cryptocurrencies offer users.

✅Conclusion

In simple terms, staking is the act of earning a profit by holding digital currency in a specific location, such as a wallet or exchange account. To stick cryptocurrency, there are two methods for owners; The first solution is to keep it in the wallet. This method is called cold stacking. The second method is a stake in a cryptocurrency exchange. This method can be done in two ways: Locked and Flexible, which we will learn more about later. In order to better understand how the digital staking system works, you must first have a good understanding of the Proof of Stake algorithm. Proof of Stake (PoS) is a consensus mechanism that allows blockchain systems to work more efficiently while maintaining a good level of decentralization (at least in theory).