Pump and Dump is an illegal practice in the financial markets and is not limited to the digital currency field. But now, due to the expansion of the internet space and especially the popularity of encrypted digital currencies, this method is more common among fraudsters compared to before. Unfortunately, the lack of rules and regulatory frameworks for the cryptocurrency space has resulted in digital currency pumps and dumps becoming a target for fraudsters. Due to the presence of digital space, people can easily invest their capital and transact in this space. The digitization of many investments has made the environment much easier for fraudsters to penetrate than before. Now it is safe to say that the digital currency market is the most likely place for these fraudsters to operate, especially with digital withdrawal and withdrawal methods. Stay with Digital Currency Signal for more pump and dump information.

What is a pump and dump?

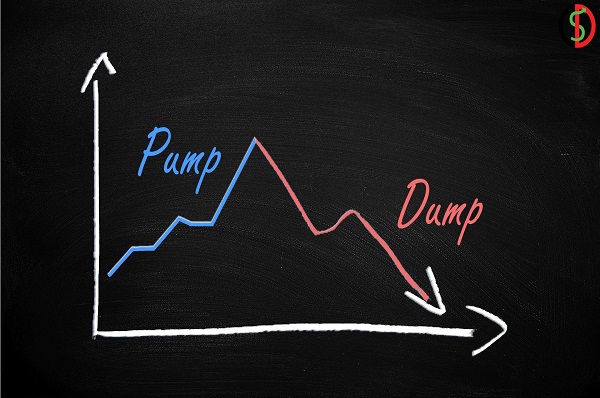

Dumping and dumping is a market strategy strongly opposed by conscientious investors. People who invest heavily in commodities and stocks when prices are low, and then advertise heavily, often use misleading and false advertising. This work is part of the term mentioned above, which is called “pump” and for example in advertising they say that now is the best time to buy currency and this increases demand and increases the price. When dumping occurs, the target people sell their shares at the highest price. This work usually brings them profit, but after some time the value of the same product decreases. This part of the word is called “dump”. Digital currency markets are as vulnerable to pump and dump schemes as any other market. To avoid this, aggressive investing should be avoided and investors should quickly identify sources of misinformation.

How does a pump or dump work?

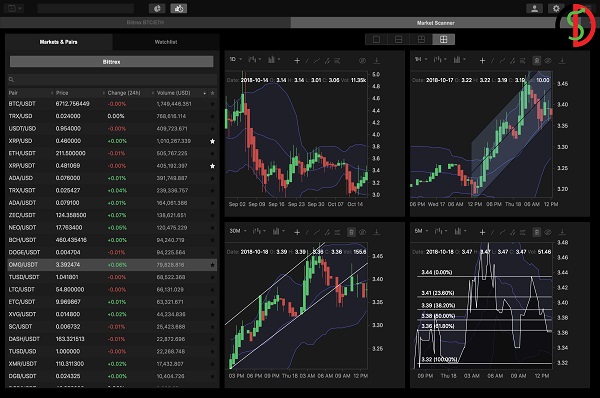

At the heart of cryptocurrency pump and dump schemes is a team of technical, motivated and organized people. These people work from different places to make currency ads real. This team often includes investors who provide money to buy tokens and increase demand. If the chosen token is a low-volume asset type, buying more of them allows fraudsters to control the supply and set the price. There are two main teams in the cryptocurrency pumping plan and the data transfer plan. The first group, also known as the home group, focuses on offering virtual currency. For example, an initial supply of 100,000 Sheba coins will be made today. The second team works on the promotion side of the pump or dump. The team encourages people to buy or sell a currency using social networks. Fraudsters even form groups and use influencers to post content related to tokens.

Investors and traders fearing that they will lose the opportunity to buy when the token price rises, participate in the market and buy tokens for more than their actual value. When the scammers finally sell all their tokens, suddenly the hype and demand dies down and the prices drop. This is why investors know that digital currency is nothing more than a pump and dump.

Useful use of pump and dump

It is true that many people use this plan as a scam, but anyone who wants to make a useful investment can use this method legally. Follow the instructions below to get the best return on your investment.

First step: First, start by following the most popular currency

Second step: When the price of the desired coin begins to rise and settles at the highest price point, buy the coin.

Final level: Keep a close eye on price action so you don’t miss price peaks and sell immediately. If you are active enough, the price will suddenly fall and it is too late to wait until the price falls.

Identifying digital currency pump and dump

When you can identify the pump and dump it properly, you can protect your capital. Digital currency has a lot of value and people try to invest a lot in digital currency. That’s why it’s important to quickly spot pumps and dumps in the crypto world. To identify a currency pump and dump, it is better to read its RODMP and white paper carefully. Studying the white paper can show investors the goals of a project. It is possible to recognize whether the purpose of the digital currency is fictitious or real, and whether the project is fraudulent. You can then check the cryptocurrency you want.

For that, it is better to know the fundamental analysis process so that you can properly analyze the cryptocurrency. If a cryptocurrency goes through unusual and sudden trends, you should pay special attention to them and remember them if possible. These events can indicate irrational behavior leading to pump and dump. One of the problems that traders face is the buying and selling mentality. Arousing and using emotions is one of the main goals of leading teams. They encourage users to buy digital currency. Therefore, before buying a cryptocurrency, it is better to check it thoroughly and not pay attention to its increase in price. Because this price increase can suddenly cause a lot of damage.

Types of pumps available in the market

In general, pumps fall into two general categories, including:

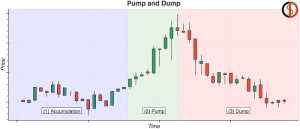

- short term

In the short-term pump type, the value of the digital currency increases within seconds. In fact, this type of redemption occurs when many customers participate in the market. Usually a timer is set when the cryptocurrency is pumped, after which traders start trading. However, remember that pump contributors will want to know about the target growth percentage. ‘

- long time

Pumps are long-term, lasting from a few days to a few months. The advantage of a long-term pump is that there is some understanding of the digital currencies that will be pumped. For example, a series of coins is selected. In this PUMP model, all participants receive a variety of stories about money that they choose to share with people on social media, exchanges. In this case, the amount of demand from the user also increases.