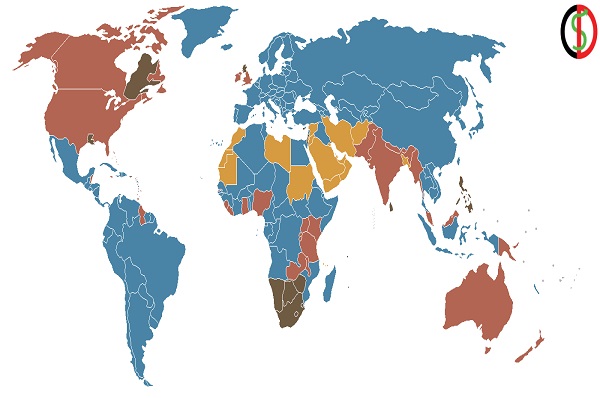

Check with the authorities in your nation to see whether it is OK for you to purchase, sell, or use Bitcoin before you do so. In point of fact, several nations have developed a variety of policies regarding cryptocurrencies. Some of them even single out Bitcoin, enabling it to be utilized as money, pay taxes, buy things, or exchange it as a commodity. This is all made possible by these new regulations.

In certain countries, being caught with even a little amount of bitcoin on your person may land you in jail. Bitcoin and other cryptocurrencies are now in a legal gray area since others have not even attempted to govern it yet. Here in this digital currency signal article we look at laws of some countries regarding cryptocurrencies.

America (United States)

The United States is a leading investor in cryptocurrencies, both directly and indirectly via blockchain companies and crypto investors. However, the nation has not yet developed a comprehensive regulatory framework for cryptocurrencies like bitcoin and ethereum.

Exchanges for cryptocurrencies are subject to the requirements of the Financial Crimes Enforcement Network (FinCEN) and are within the ambit of the Bank Secrecy Act (BSA). The Anti-Money Laundering (AML) laws and duties to fight the Financing of Terrorism are another set of regulations that exchanges are needed to comply with.

Russia

It was recommended in January 2022 by the central bank of Russia to prohibit the use of cryptocurrencies and the mining of cryptocurrencies on Russian territory. The bank cited dangers to financial stability, the wellbeing of people, and Russia’s control over its monetary policy.

The action is the most recent in a series of worldwide crackdowns on cryptocurrencies. Governments from Asia to the United States are concerned that privately run digital currencies that are extremely volatile will threaten their control of banking and monetary systems.

India

The government has made remarks indicating that it plans to impose taxes on cryptocurrencies, but it has not suggested that the use of cryptocurrencies is currently sanctioned. Even though it has not been voted into law yet, the proposed legislation would almost certainly provide clarification. In the year 2021, the Standing Committee on Finance said that crypto-assets would be subject to regulation, and a proposed regulatory framework for cryptocurrencies was presented to the legislature at the same time.

The government is working to clarify crypto’s legal position and the regulatory framework, but in the meanwhile, they have made progress on a number of tax rules. According to Chainalysis’ worldwide index of crypto adoption, the active cryptocurrency market in India ranks fourth overall.

Turkey

As the value of the Turkish lira continued to fall, more people in Turkey began to invest in bitcoin. This year, when the rate of inflation reached its greatest point in April, limits were quickly implemented despite the fact that use levels were among the highest everywhere in the world.

Direct or indirect usage of cryptocurrencies such as Bitcoin was made illegal by a rule that was released by the Central Bank of the Republic of Turkey on April 16, 2021. This law prohibits the use of cryptocurrencies to pay for goods and services in any way. The next day after that, Turkish President Recep Tayyip Erdoan went even farther and signed a decree that included cryptocurrency exchanges to a list of organizations that are subject to anti-money laundering and terrorist funding regulations.

Spain

Through vigorous lobbying and promotion of the European Blockchain Partnership, Spain is leading the other member states of the European Union in their fight for a legislative framework that is applicable throughout the whole continent of Europe.

The Spanish government has eliminated taxes on transactions using cryptocurrencies, and Spanish banks are investing in Bitcoin firms and frequently providing funding to blockchain startup businesses. As a result of the favorable climate, several of the largest worldwide bitcoin firms have chosen to establish their headquarters in Spain.

Venezuela

Having launched its very own coin in 2017 that was backed by petroleum, Venezuela presented itself as an ideal prospect for the broad adoption of cryptocurrencies. In 2018, it was determined to be against the law, and in January of 2020, attempts were made to make it lawful once again.

Mining had been unlawful, and individuals who engaged in it were facing penalties; however, the charges have since been dropped against them. Activities involving cryptocurrencies have just been given the green light in Venezuela.

France

In accordance with the provisions of the Monetary and Financial Code, France has enacted legislation governing cryptocurrencies and crypto assets. Utility tokens, payment tokens, and security tokens are the three types of digital assets that the government has specified. Non-fungible tokens are not subject to regulation by the MFC.

The law also regulates firms that provide services related to digital assets, such as those that buy or sell digital assets, provide exchange services, act on behalf of others, or give advice. These types of activities fall under the broader category of “digital asset services.”

Canada

In the past, Canadian officials have shown a positive attitude regarding the use of cryptocurrencies inside the nation. It was the first nation in the world to give its approval to a Bitcoin ETF in February of 2021. In terms of taxes, bitcoin in Canada is taxed in a manner somewhat dissimilar to that of conventional commodities.

On the other hand, organizations that deal in crypto investments are categorized as money service enterprises. As a consequence of this, they are required to register with the Financial Transactions and Reports Analysis Center in Canada.

Conclusion

Bitcoin’s price has been affected for an extended period of time by the persistent worry that massive cryptocurrency crackdowns may occur. As a result of this, many individuals continue to be skeptical of trustless systems and choose to depend on conventional banks instead.

Despite this, an increasing number of governmental institutions are opting to participate in the digital innovation business and embrace its advancements. At the same time, governments that are opposed to the developing sector run the danger of falling behind other areas. Ironically, these countries are already among the poorest in the world, and massive crackdowns on Bitcoin and other cryptocurrencies do not seem to be producing any positive consequences to better the situation.