Many people know the DCA method as a “slow buy” or “low discount” and show it as a good way to get digital money. As traders in the digital currency market, we often face difficulties when buying cryptocurrency because we want the price to be too low. For this reason, we wait for the price of the currency to reach the lowest level, but this will destroy the continuous growth. This is how investors are deceived by the market and drawn into the volatile cryptocurrency market. In these situations, questions like when is the right time to buy digital currency, occupy the attention of traders. Today, different types of trading strategies help us have a more successful investment. In this article from the specialist journal digital currency signal, we present and review the DCA strategy.

What is DCA’s strategy?

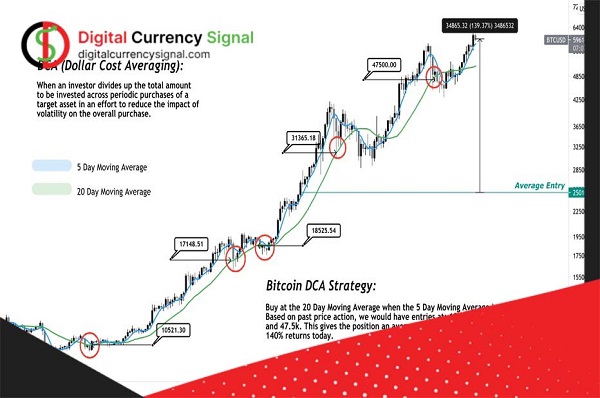

If you are active in the digital currency market, you may have heard of the DCA strategy or Dollar Cost Averaging, and if you want to learn about this strategy, you may also have asked the question What is the DCA strategy? We can answer this question that the DCA strategy or buying strategy is one of the best strategies that people in the digital currency market can use as a useful technique. DCA invests a certain amount in a predetermined asset at a fixed time, giving people more direct control over the investment and thus allowing investors to know what position they should be in. This method ensures that the sentiment of investors in the financial markets is not affected.

It is interesting to know that the DCA strategy refers to the method of systematically investing equal amounts of money over a fixed time frame, regardless of price. The purpose of the DCA strategy is to reduce the overall impact of fluctuations on asset prices. The purpose is also to prevent the mistake of making a one-time investment due to the asset price not being properly timed. In essence, the Phased Buy Strategy, or DCA, is a method investors and traders can use to build savings and profits over an extended period. In addition, this strategy is a way to reduce short-term fluctuations in the digital currency market, which can be very useful.

What are the advantages of the DCA strategy?

1. Risk reduction

One of the advantages of the DCA strategy is that many traders and investors use it in the digital currency market. It reduces the level of investment risk and protects the capital so that the market does not fall. This strategy preserves capital and provides liquidity and flexibility in managing the investment portfolio. DCA allows you to avoid losing investment by buying a currency when its price rises.

2. Low price

One of the advantages of the DCA strategy is its low cost. It is better to know that buying a digital currency and investing in the market when the prices are falling ensures that the investor will get a higher return and can buy a lot of digital currency compared to when the prices were high.

3. Emotional Investment Management

Another advantage of the DCA strategy is the management of the emotional investment. It is good to know that emotional investment cases are caused by various factors such as large investment at one time and prevention of financial loss. Using DCA eliminates or minimizes emotional investment.

Who is good at step buying strategy?

- Investors who have fixed and continuous investment plans for themselves.

- Investors who have little free time to constantly be in the digital currency market.

- Investors who have entered the market.

- Investors who buy at the peak and their equity lose when the price falls.

How does the DCA strategy work?

The step purchase strategy is a simple method that investors can use to grow their investment in the long term. This allows the investor to ignore short-term fluctuations in the market. When traders use this method, they are effectively buying both the highs and the lows of the cryptocurrency market. The general idea behind the DCA strategy is that eventually, the price will rise. It is very risky to use this strategy on digital currencies because we don’t have proper information about their plan. After all, the price of the coin may fall and we are motivated to buy the coin. In the end, I found that the project lost value and did not grow fast enough.

A DCA strategy minimizes investment risk by periodically buying assets. This means that when prices are high, we buy less currency and when they are low, we buy more currency. For example, we are going to invest $1,200 in Ethereum currency. We have two options: we can invest all of our money in this currency all at once, or we can invest $100 per month. If we break our purchases into $100/month fractions over 12 months. We can earn more Ethereum if we put all our capital into it instead of buying the currency at once.

DCA is a good strategy

A short sale strategy or DCA is a type of investment strategy whose goal is to minimize the impact of volatility when investing or selling a large block of assets or financial instruments. DCA strategy is a method of dividing the investment into smaller amounts and investing them separately at predetermined intervals until the entire capital is exhausted, instead of buying stocks all at once. In general, investors using the DCA strategy reduce their investment costs over time.

The importance of a ladder buying strategy is to minimize the psychological impact of investors and market timing on their portfolios. By following the DCA approach, investors avoid the risk of making negative decisions due to greed or fear. This is like buying more when the price goes up or selling a digital currency wide when the price goes down. Instead, this strategy, or so-called staged buying, forces investors to focus on getting a certain amount of money in each period, ignoring the price of each individual purchase.

FAQ

How does the DCA strategy work?

The step purchase strategy is a simple method that investors can use to grow their investment in the long term. This allows the investor to ignore short-term fluctuations in the market. When traders use this method, they are effectively buying both the highs and the lows of the cryptocurrency market.

What are the advantages of the DCA strategy?

1. Risk reduction, 2. Low price, 3. Emotional Investment Management