If you are also in the field of cryptocurrency, you must have come across the term FOMO many times. If you are new to this activity, you probably still don’t know the full and precise meaning of this key term in the cryptocurrency market. FOMO is considered to be one of the fear factors in the world of digital currencies that have had a significant impact on determining the direction of the cryptocurrency market; Therefore, we suggest that you prioritize the answer to the question of what FOMO is in cryptocurrency, as well as the reasons for its occurrence and how to manage it. In this article, you will find all the answers you need about the concept of FOMO.

What is FOMO in crypto?

FOMO stands for “Fear of Missing Out”. Fomo in cryptocurrencies and the world of trading and financial markets in general refers to the fear a trader or investor feels when they miss out on a profitable investment opportunity. This sentiment is especially true when the value of a particular asset has increased significantly over a relatively short period. Fomo in business can lead individuals or even entire market participants to make emotional decisions instead of logic. Such decisions are dangerous for unethical investors, especially those with small capital because they often result in transactions in which the asset’s value is higher than its true value, increasing the potential for capital loss.

What are the causes of FOMO in cryptocurrency?

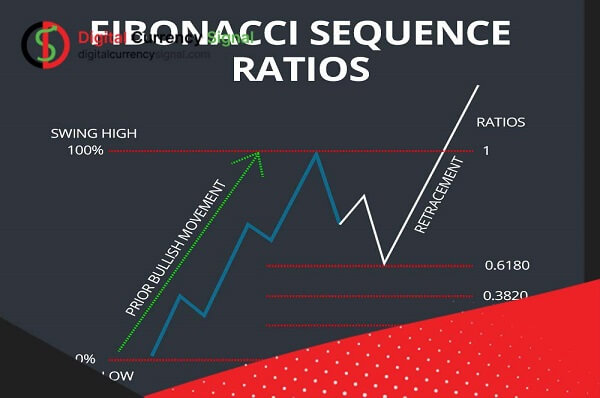

Generally, people experience FOMO when they feel lost through events, products, or business opportunities. The fear of losing the digital currency comes when the price starts to rise. Traders and investors feel that they are missing out on a huge opportunity to make profits. FOMO in cryptocurrency is so strong that it makes you make quick decisions without doing proper research, including technical analysis and fundamental analysis of the cryptocurrency. The three key factors effective in creating digital currency FOMO are:

1. High-Profit Potential of the Cryptocurrency Market

Cryptocurrencies are an exciting new asset class that offers massive capital growth potential. The fact that people do not want to miss such an opportunity to make huge profits is one of the main reasons for FOMO in cryptocurrency.

2. High volume of ads

The sheer amount of hype around the cryptocurrency market is another reason why FOMO is so common with digital currencies. Social media, forums, and blogs are full of information about the latest price changes and investment signals in the cryptocurrency market. It can be hard to resist the urge to invest when everyone around you is talking about how much they can earn with cryptocurrency, But remember that the popularity of an asset is not a good reason to invest. Before buying any cryptocurrency, do thorough research to ensure it is suitable for investment.

3. High volatility in the market.

The final reason for FOMO in digital currencies is low trust in this market. Digital currencies are still new and their prices fluctuate a lot, which means that there is always a risk of a price drop and on the other hand everyone desires to get a profit from ‘ a volatile market.

How do you deal with FOMO?

Fear of loss or FOMO can happen to traders, but FOMO can be prevented in the cryptocurrency market, which we will discuss below:

Determine investment strategy

Investment strategies are a set of rules that are formed based on the beliefs of the investor. Investors determine their trading path by defining an investment strategy. Of course, remember that even having defined an investment strategy, there is a possibility of missing investment opportunities in such a way that even a well-known investor cannot access all investment opportunities in the market. Various factors such as capital size, risk tolerance, and skills should also be taken into consideration when determining business strategies. By determining these things, you will be able to make all your trades with full knowledge of the most sensitive conditions and avoid the excitement of the market.

Get news from reliable sources

Try to get cryptocurrency news and events from reliable sources. This is why digital currency supporters and investors constantly follow market news and analysis. You should always keep this information in mind as these reports may contain false information that can cause the trader to lose. Therefore, to distinguish fake news from real news, one must examine the rationale behind the news.

He’s not interested in social media

These days, social networks have become an important part of people’s lives, and people’s lives seem to be winning all the time. This model of news and daily news about digital currencies also exists, and there are countless people in the digital currency network who have made great fortunes by buying and selling digital currency. Combining trading with social media is a very dangerous combination for traders because social media is an ideal platform for new developments that should never be used to make big decisions.

✅Conclusion

In this article, we have tried to explore one of the most common emotions in the trading world, especially in digital currency trading, namely FOMO. As you may have seen from reading this article, FOMO can be described in one sentence: the fear of missing out on something precious and following others. Fomo is a general feeling that can disturb and rob you of peace, not only in the financial market but in all human life. This feeling has increased in the modern world thanks to the presence of social networks and has become one of the main challenges of today’s life.

As a final point to the article, being self-reliant doesn’t mean you don’t ask anyone for help. If you feel that you lack the ability to analyze and forecast the market, you can get help from people who are experts in the field and trust their guidance. If you do not want to experience major losses and do not have bitter memories of financial markets in your heart, do not make decisions based on fleeting emotions and multi-day trends.