The digital currency market is developing and improving every day, and this makes many people think of making money in the digital currency market. But the truth is that the more you can earn and get rich in this market, the more likely you are to lose a lot of capital. In a situation where everyone knows about market risk-taking and tries to reduce it, hedging is used as a strategy to cover market risk. For this reason, we want to learn more about digital currency hedging in this article. Stay with the digital currency signal.

Hedging means buying assets to reduce the risk of loss from other assets. Hedging in finance is a risk management strategy that works to reduce and eliminate the risk of uncertainty. This strategy helps cover losses that may occur due to unknown fluctuations in the price of the investment.

Hedging in digital currency

If you are active in the digital currency market, you must have heard the name digital currency hedging and wanted to know about this concept, perhaps the question came to your mind, what is digital currency hedging? We can answer this question by saying that digital currency hedging is an investment method that aims to reduce the risk of extreme fluctuations or reduce risks in transactions. Hedging means protection and usually involves finding a negative or opposite position in a digital currency. Hedging is also considered a modern investment strategy.

It is interesting to know that Hedge means to cover and protect a part. Therefore, we understand that hedging in the digital currency market means reducing the amount of investment risk and is a market risk protection strategy. In this way, you should pay attention when you use trading hedging strategies. The amount of profit you get from trading will be less if you don’t rely on this strategy. Hedging is a way to minimize large losses in situations where there is a downward trend in the market. That is when you see a digital currency falling and you have no choice but to enter a transaction and hedge some of it. Because of this, you are less likely to lose.

What are the types of hedging strategies?

As we said, digital currency hedges are an investment method that aims to reduce the risk of excessive fluctuations or to minimize the risk in transactions. There are various hedging strategies and each is unique in its way. Traders are advised to use not only one strategy but also others to make a profit. For this purpose, in this part of the article, we try to review the types of digital currency hedging strategies.

1. Diversity

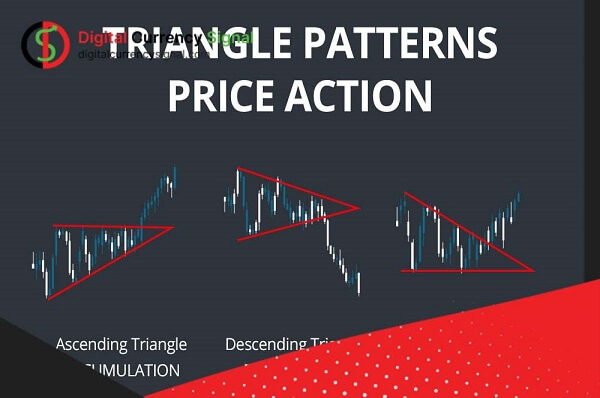

One of the digital currency hedging strategies is to diversify the digital currency asset portfolio. Try not to put all your eggs in one basket. Diversification is when a trader invests his capital in things that do not move in one direction. It is a method of investing in different assets that are not related to each other so that if the price of one of them goes down, the others will go up.

2. Arbitration

Another type of digital currency hedging strategy is arbitrage. This strategy involves buying a digital currency and quickly selling it on another exchange at a higher price. Thus, a small but constant profit is obtained. This strategy is commonly used in the digital currency market.

3. Let’s reduce the average value

Averaging is another type of digital currency hedging strategy that involves buying more units of a cryptocurrency even if its selling price drops. Digital currency investors mainly use this strategy to hedge their investments. If the price of the digital currency you bought before drops significantly, they will buy more of the same currency at a lower price.

What are the benefits of hedging?

- Using discount instruments such as futures allows investors and traders to reduce risk.

- This strategy is an effective way to get real profit.

- It reduces the impact of price fluctuations on the trader’s portfolio.

- Hedging provides new insight into market movements.

- This strategy is easy to start and use.

- You can use this strategy with many cryptocurrencies.

Is there no risk in hedging?

The concept of hedging and its principles seem very simple. Is there anything other than selling at a high price and buying at a lower price? The fact is that hedging is an advanced trading strategy. You need to constantly monitor the market, follow the news, analyze projects from a technical and practical point of view, look at price charts, and, most importantly, have trading experience. It is important to know the basics of technical analysis to be able to predict a price hedge.

Investors indeed use hedging methods to reduce risk, but there is no guarantee that this method is risk-free. The best approach when applying this strategy is to consider the pros and cons of each asset’s coverage. You should also check whether the benefits of the hedge are worth the cost. Do not forget that in some cases, such as when the market is neutral, the hedge can move back.

Conclusion

In this article, we learned about hedges as a way to reduce risk and preserve money. Hedging is a way to reduce large losses in a bear market situation. This means that when you see a stock falling and have no choice but to enter a trade, you hedge a portion of it. So you will have fewer losses. You know that the cryptocurrency market is constantly fluctuating. These fluctuations tell traders that it is not unlikely that the exchange rate will rise or fall sharply. This is a point related to taking market risks. in this situation, Traders consider the possibility of a market decline. He turns to hedging strategies to preserve his assets. But none of this information is intended to eliminate the risk of trading. To use this method, you must always follow the market and get a lot of information.