Traders in the cryptocurrency market use different strategies and methods to profit from price fluctuations. Each of these trading strategies and techniques has its own characteristics. Therefore, knowing the characteristics and performance of each of these trading methods will help you choose the best trading strategy. One strategy is grid trading. For this reason, in this article we want to explain to you the Grid Trading strategy. Let’s take a look at the advantages of a grid trading strategy and test the performance of grid trading.

What is a grid trading strategy?

You might be interested to know that the Grid Trading strategy is one of the best trading strategies in the cryptocurrency market and has been around for a long time. The purpose of this strategy is to create a transaction network that increases the profitability of transactions in the crypto market. Users can implement their own trading strategies in automatic mode using the Trading Grid robot. Create an order network that provides the market action possible in this technology.

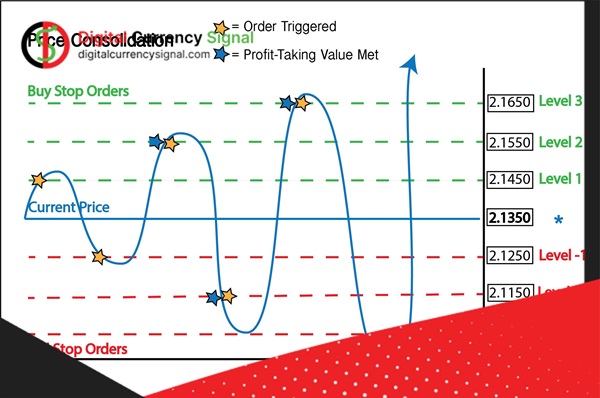

Grid trading is one of the automated trading methods in the cryptocurrency market, where a trader places an order for a high or low level for a specific price level. Automated orders are executed by Grid Trading robots to create a successful online trading strategy. Therefore, the bot automatically places its order within a specific price range. It creates a system of orders that covers various potential market movements.

What is Grid Trading Robot?

An online trading robot is a trading algorithm or code designed to profit from price changes within a given range. The trader sets parameters or limits for the network trading robot in a predetermined range and according to certain rules; Therefore, online trading bot orders automate cryptocurrency trading. Let’s continue with an example of the BTC / USDT trading pair to understand how the grid trading robot works and the parameters it considers.

Consider that the price of Bitcoin has been close to $15,000 for the past two weeks. A trader has 5000 Tether and decides to trade $600 above and below the current price range. This means a high price of $15,600 and a low price of $14,400.

The next step is to divide the value of the area between the upper and lower bounds into grade levels. Each exchange has its own rules. However, manual and automatic settings are available on all major exchanges such as Binance and Baybit. In manual mode, the trader can choose the number of levels himself, and in automatic mode, the grid levels are set automatically. The number of grids selected determines the number of buy and sell orders in that grid. In this example, it is set to 7 levels. The result is a predefined range, as shown below, within which the grid trading robot operates. When the price rises and crosses the sales network, the bot sells bitcoins and makes money.

Similarly, when the price drops in the Toko network, the bot automatically buys bitcoins. Trading continues with the goal of making a profit until the trader stops the robot or the timer runs out. It is important to note that all of the above sections are examples only. Rates may vary depending on investment objectives, risks and benefits.

Is the grid trading strategy profitable?

Grid trading strategies have the potential to generate profits if the grid parameters are carefully adjusted. Although the grid area and level are required to set up a grid trading bot, the following conditions and settings are optional for most crypto exchanges.

- Start price: This is the default value at which the Grid trading robot starts working. There will be no buying/selling until the market price reaches the trigger price. When the market price and the trigger price are the same, the robot will be used.

- Limit strat: As the name suggests, Grid Robot is the point at which all positions are automatically closed to protect traders from large losses. The stop loss zone is below the lowest price limit and the trigger price.

- Profit Withdrawal: This is both above the high price limit and the threshold. When the market price reaches the take profit price, the robot will sell the cryptocurrency, lock in the profit and stop the trade automatically.

Another important aspect to consider when using Grid Trading Robot is the trading fees. If the trading fees on an exchange are high and the Grid Trading Robot makes several trades quickly in a short period of time, the trading fees can be a significant amount reducing the overall profits.

Benefits of Using a Grid Trading Strategy

1. Ease of use

Unlike fundamental analysis, which requires an in-depth study of volatility, price movements and financials of the project, monitoring the quality of the development team and factors affecting the price flow in the market, and many other things, Using a grid trading strategy requires only price as input. In addition, when the reference or base price is determined by the trader, the robot executes the grid trading strategy based on its data without the trader’s intervention and the trader does not need to constantly monitor the market.

2. Ability to customize and personalize

Users can choose more or less price levels to implement this strategy depending on their personal preferences and circumstances. Also, this strategy can be combined with other trading strategies, of which technical analysis is one of the most popular. For example, users can use a trend line as a reference price.

3. Adapting to all market trends

The grid trading strategy is a suitable method for trading different types of trends in the market, whether the market is moving in one direction or stuck in a certain range. Of course, this does not mean that using this strategy is always profitable. Users should be aware that markets are highly unpredictable and can change direction quickly without signs of a reversal. So it is a very good idea to combine other risk management methods (described below) with this plan.

4. There is no emotion in the transaction

As you know, trading is a job that causes a lot of stress and emotional conflicts, and this emotional involvement can lead to wrong trading decisions that ultimately bring only losses to the trader. The main advantage of trading using a grid strategy is that due to its systematic nature, human judgment and emotions are eliminated from the trading process.