There are two ways to trade and buy and sell digital currency, using an exchange or using a broker. The two have differences that are not visible to the public. In what follows, we will first define these two concepts and then examine the things that traders should consider when buying digital currency on an exchange or a broker’s online trading platform. Exchanges and digital currency broker systems are the main platforms for buying and selling cryptocurrencies. Each of these systems has its own characteristics and differences from each other. Cryptocurrency users choose one of these two systems to invest and buy and sell based on their conditions and type of transactions.

What is a digital currency broker?

A broker is a natural or legal person who acts as an intermediary in buying and selling. Brokers work in various trading systems such as the stock market, buying and selling oil and precious metals, real estate, and digital currencies among many other markets.

Brokers deposit or lock the amount in the customer collection account. Then, according to the daily rate published by the trader, they publish their buy and sell orders. The brokerage registers the clients’ orders and buys and sells on their behalf for the amount locked by the client in the brokerage account and takes a percentage of the trade profit as a commission. Buyers in these collections do not have the possibility of direct purchase and sale, but rather give the authority to buy and sell and raise the commission to the broker with a predetermined contract.

A digital currency broker, known by the acronym OTC, is a trading network that allows users to access through a website or app. These systems are called OTC markets. At these meetings, the current price and recommended prices of cryptocurrencies are announced and buying and selling are done based on these prices. Digital currency brokers match the buy and sell requests of users to each other according to their assets. The buying and selling process on these platforms is faster and easier than centralized crypto exchanges.

What is a crypto exchange?

We all know the traditional exchanges. These collections are where you can trade common world currencies and convert one currency to another. The operation of digital currency exchanges is the same as traditional exchanges, with the difference that cryptocurrency exchange is an online platform, and all transactions in these systems are done online. These systems can be centralized or decentralized. Users of these platforms can convert their fiat currency into cryptocurrency or vice versa.

They can also exchange different digital currencies with each other. All transactions on the platforms of these exchanges include a percentage of the transaction amount as fees. Binance and Coinbase are among the best digital currency exchanges in the world. Prices on cryptocurrency exchanges change instantly and trades and purchases are made based on these prices. The price in these systems is determined by the number of buys and sells, or the supply and demand of cryptocurrencies. According to the usual supply and demand formula, buying a currency also increases its value, and a decrease in demand for a currency causes its value to decrease.

What is the difference between a digital currency broker and a cryptocurrency exchange?

So far we have reviewed how it works and the features of cryptocurrency exchanges and brokers. So far we have reviewed how it works and the features of cryptocurrency exchanges and brokers. You should familiarize yourself with the main differences and advantages of these two systems. We will discuss these differences below.

1. Broker provides analysis tools to users

Buying and selling on digital currency exchanges requires no experience. Users can start buying, selling, and trading by registering on these platforms and loading their user account through fiat currency or transferring their cryptocurrency assets to these platforms. Exchanges do not provide their users with special tools to analyze the market and test ideas and strategies. Meanwhile, users can buy and sell professionally on the digital currency broker platform.

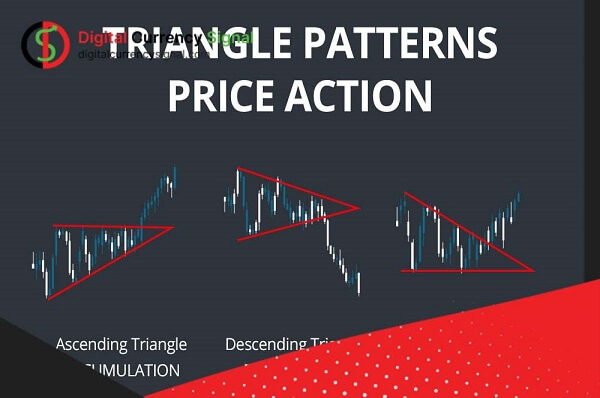

These systems provide some analytical tools to their users. A broker user can view multiple charts in multiple windows and compare prices in multiple currencies. They can also use the indicator on the charts to take a closer look at the state of the market.

2.The variety of cryptocurrencies is more on exchanges

Cryptocurrency exchanges offer users a diverse list of coins and allow them to buy and sell and exchange large amounts of cryptocurrencies. But brokers offer a limited list of altcoins. Each broker supports a number of cryptocurrencies, but generally popular digital currencies such as Bitcoin, Ethereum, Ripple, and others popular currencies can be bought, sold, and exchanged on exchanges.

3. Deposit and withdrawal methods vary between exchanges and brokers

Some well-known foreign exchanges, such as Binance, do not offer fiat currency top-ups. Users of these systems can only enrich their accounts with cryptocurrency. Before starting their transactions on the platforms of such exchanges, users must purchase cryptocurrency in other systems and then transfer their assets to those exchanges. but on the broker’s platform, the User cannot top up his account with cryptocurrencies.

These systems made it possible to load users’ wallets only with fiat currencies. At a digital currency broker or broker, you can easily load your account with credit cards or other payment methods and start cryptocurrency transactions.

4.The conditions for registration with the broker are a little more complicated

The registration and authentication process is done more precisely on the broker platform. To be verified on these levels, users must provide a document containing their residential address in addition to their proof of identity, which is usually accepted as a passport. Authentication time with brokers is faster compared to exchanges.

Therefore, if you intend to use a digital currency broker, you should act with full knowledge and sufficient knowledge of the risks of accessing these systems. You can start with a small amount to reduce the risk, and after familiarizing yourself with the system, its limitations and risks, you can continue working with brokers.