One of the main concerns of users and stakeholders in the digital currency market is finding the best time frame for fluctuations. Swing trading is one of the digital currency market strategies that has its fans among traders. Learning to swing profitably in this trading market requires knowing the correct time period for each type of swing. You should know that the best time frame depends on each person’s strategy and goals and you cannot apply the same version to everyone. Needless to say, the learning curve is one of the first and most important lessons of technical analysis. In this article, we will first determine the time frame, and then explain how to reduce the risk of transactions by choosing the right time and confirming them accordingly.

What is the time frame?

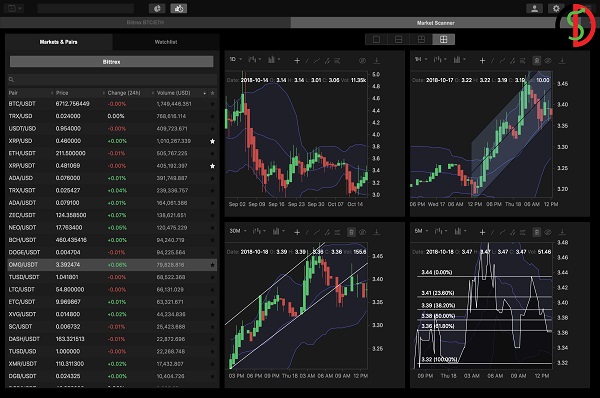

A time frame or price period refers to the time period during which a price bar or candlestick forms on a chart. In short, every trader who intends to profit from fluctuations and price fluctuations must find the best time for this purpose. During the time frame, the price forms a bar or candle, and the shape and information of the candle depends on the choice of time frame. For example, 5 minute time frame candles are completely different from daily time frame candles. With the help of volatility and trading strategy timeframes, you can test and analyze the desired timeframes and accordingly discover the best strategy for each stock or cryptocurrency.

Generally, the time limit or time period determines the amount of risk of the transaction and the time required to reach the result of the analysis of the trader and the transaction. For example, a trader takes less risk if he considers a time frame of one week. On the other hand, the shorter the period chosen, the greater the risk. On the other hand, in the weekly time frame, traders have to wait for several weeks to make a profit, but this process is very short in choosing a period of a few minutes and maybe less than an hour. Therefore, when choosing a time frame, you can choose any time frame, but this choice will be based on different people’s goals, strategies and risk tolerance.

What are the types of time frames?

Now that we are familiar with timeframes, it’s best to take a quick look at the types of timeframes in financial markets so that we can choose the desired timeframe based on our trading characteristics. Most traders divide trades based on timeframe into the following three categories:

1.Short-term time frame

In such a time frame, transactions start on the same day and end on the same day, or they are closed. This type of time frame based transaction is called short term time frame. In this strategy, the trader spends few hours of trading time. The s hort time frames that are more popular among traders are usually 1 hour, 4 hours and 15 minutes.

2.Medium-term time frame

Sonig refers to traders who use short-term time frames to make profits and avoid losses in the financial markets. This type of time frame is one of the safest and least risky time frames in the stock market. For this type of time frame, 1, 2 and 3 month intervals are selected and the price action is examined in one of these time intervals.

3.Long term time frame

This type of time frame is not very useful in swings, and most traders who go for swings do not choose long time frames. A long-term period covers a period of one to two years, and traders who use this period have a long-term perspective. In addition to dividing time frames in terms of different time periods, we have another type of classification that we will consider together below.

What is the best time frame for digital currency?

The best time frame is definitely the time frame that has more profit with lower risk; But this definition is by no means a precise definition. Choosing the best time frame for digital currencies is not much different from other financial markets . But before you start trading in this market, you should note that the digital currency market in the short term may not move according to your technical analysis. Below, we will go over the choice of time frame together in different scenarios:

Best time frames for swing and day trading

If you are looking for the best time for day trading or the opposite, you should remember the important things about this topic. In swing traders, they often stay in the trade for a very short time and exit the position quickly. Depending on the time frame the trader stays in the trade, the best time frame for the swing can be chosen. Usually, in these cases, traders use short time frames for analysis, such as one minute, 5 minutes, etc. However, it is not bad to look at larger time frames. The larger timeframes show the general trends and the smaller timeframes can help identify suitable entry points. To choose the best period for day trading, first of all, you should be well trained in capital management process.

Best time frame for fundamental traders

Even if you are interested in basic research rather than specialization; Again, the time will come. In basic analysis, you don’t need short-term time frames and you can use long-term time frames for analysis as needed. Daily and weekly time frames are commonly used in fundamental analysis, however, some are more interested in monthly time frames.

Best time frame for intraday trading

Intraday trades are trades that expire within a day. Generally, 5 minutes, 15 minutes and one hour time periods are used in these transactions.

Important points in choosing the best time frame for a swing

One of the important things when choosing a time frame is to pay attention to the feelings and personality traits of each person. In other words, when choosing a time frame, should you decide whether your personality and your circumstances are better suited for a long-term time frame or a short and medium-term time frame? Because risk tolerance increases in short-term time periods, but in the long-term, there is less risk and it requires more patience. Another important point in choosing a time frame is to consider the purpose of volatility. Some people may prefer to take a long-term view and postpone their gains; But on the other hand, people have a short-term perspective and bear more risk to increase their chances of earning more in a short period of time.

✅the last word

Our purpose in this article is to look at trading in different periods and choose the best time to research and trade in the digital currency market and its pros and cons. You, our dear, first determine the purpose of the transaction and only then choose the appropriate time frame. Choosing the wrong time frame for trading leads to huge losses and is illogical. For example, a small period like 5 minutes is not suitable for long-term trading. For this reason, the choice of time frame is entirely up to you, you should choose the most suitable time frame according to your strategy, goals and personal feelings, and you should profit by controlling the price changes during the period that.

FAQ

what is Best time frame for swing trading crypto?

If you are looking for the best time for day trading or the opposite, you should remember the important things about this topic. In swing traders, they often stay in the trade for a very short time and exit the position quickly. Depending on the time frame the trader stays in the trade, the best time frame for the swing can be chosen.

What are the types of time frames?

1.Short-term time frame 2.Medium-term time frame 3.Long term time frame